WLFI Signals Potential Reversal With Bullish ‘Three Drives’ Pattern

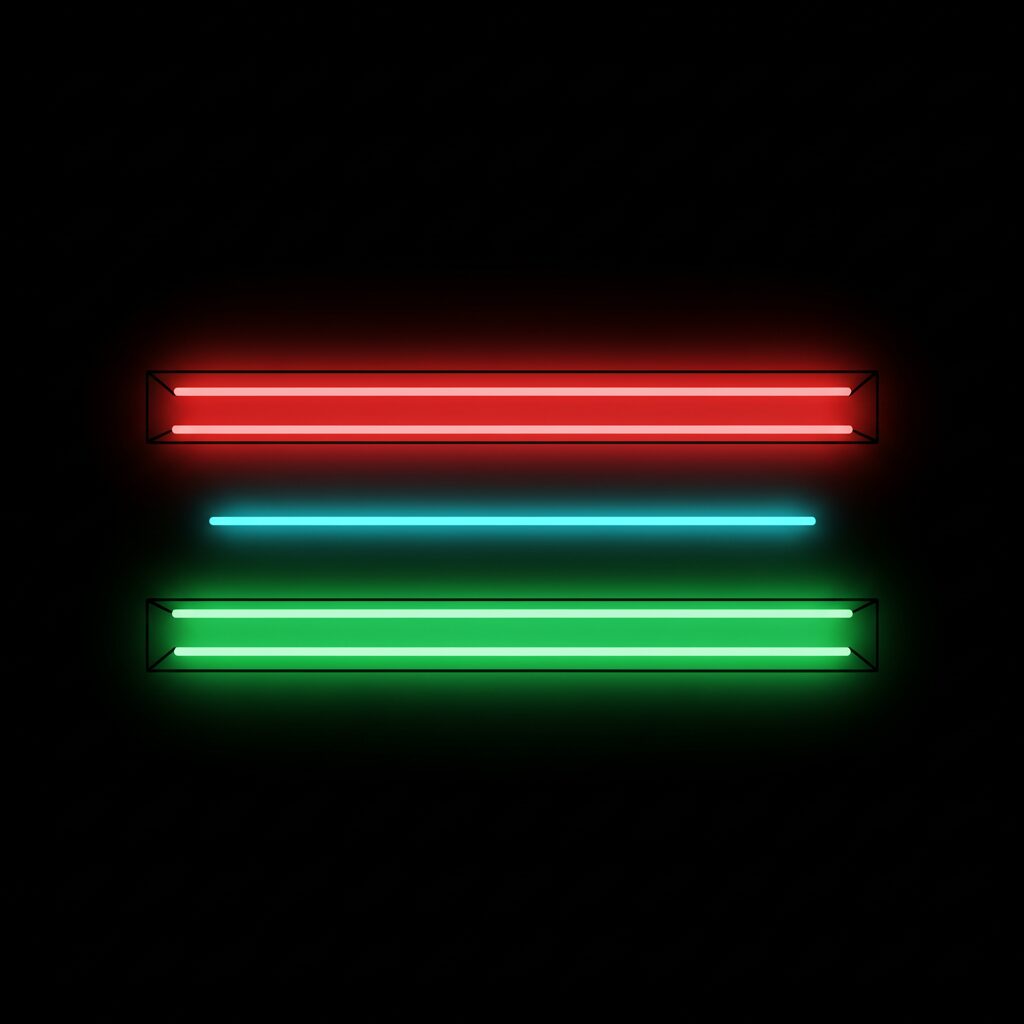

World Liberty Financial (WLFI), a Decentralized Finance (DeFi) project linked to Donald Trump, is showing early signs of a bullish reversal. The token’s price is forming a classic “Three Drives” pattern at the crucial $0.12 support level, suggesting that a period of selling pressure may be ending.

This technical formation, combined with rising trade volume, points to a potential recovery toward higher resistance levels. The $0.12 zone has proven to be a durable floor, holding firm across multiple retests and demonstrating consistent buyer interest each time the price has approached it.

A Textbook Pattern at Key Support

WLFI’s price action is developing a textbook Three Drives pattern, a structure that often signals the end of a corrective phase and the start of a new upward trend. The pattern consists of three consecutive, equalized pushes into a support level. In this case, each dip to $0.12 has been met with strong buying, indicating that market participants are actively accumulating tokens and defending this price.

As sellers become exhausted after the third drive, momentum typically shifts in favor of buyers. The repeated defense of this support strengthens the argument that WLFI is establishing a structural bottom, creating a solid base for a potential rally.

Rising Volume and Control Point Add Confidence

Further supporting the bullish outlook is a noticeable increase in trading volume. Rising volume during the formation of a reversal pattern suggests that demand is strengthening at a key inflection point. It shows that the buying pressure is not only consistent but also growing in conviction.

Additionally, the Point of Control (POC)—an indicator showing the price level with the highest trading activity—is located near the same $0.12 region. A high-volume node at a support level often indicates heavy accumulation by large-scale investors, which can act as a launchpad for a significant price move. This alignment of technical factors creates a strong confluence zone that increases the probability of a reversal.

What to Expect for WLFI

If WLFI continues to hold the $0.12 support in the coming days, the likelihood of a move toward the next major resistance at $0.18 grows substantially. A break above $0.18 would serve as further confirmation of renewed bullish momentum. However, a failure to hold the $0.12 support would weaken the current setup and likely delay any potential reversal.

This technical development follows recent news where WLFI confirmed it had suffered a pre-launch breach resulting from phishing attacks and third-party security lapses.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice, investment advice, or any other sort of advice. You should not treat any of the website’s content as such. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.