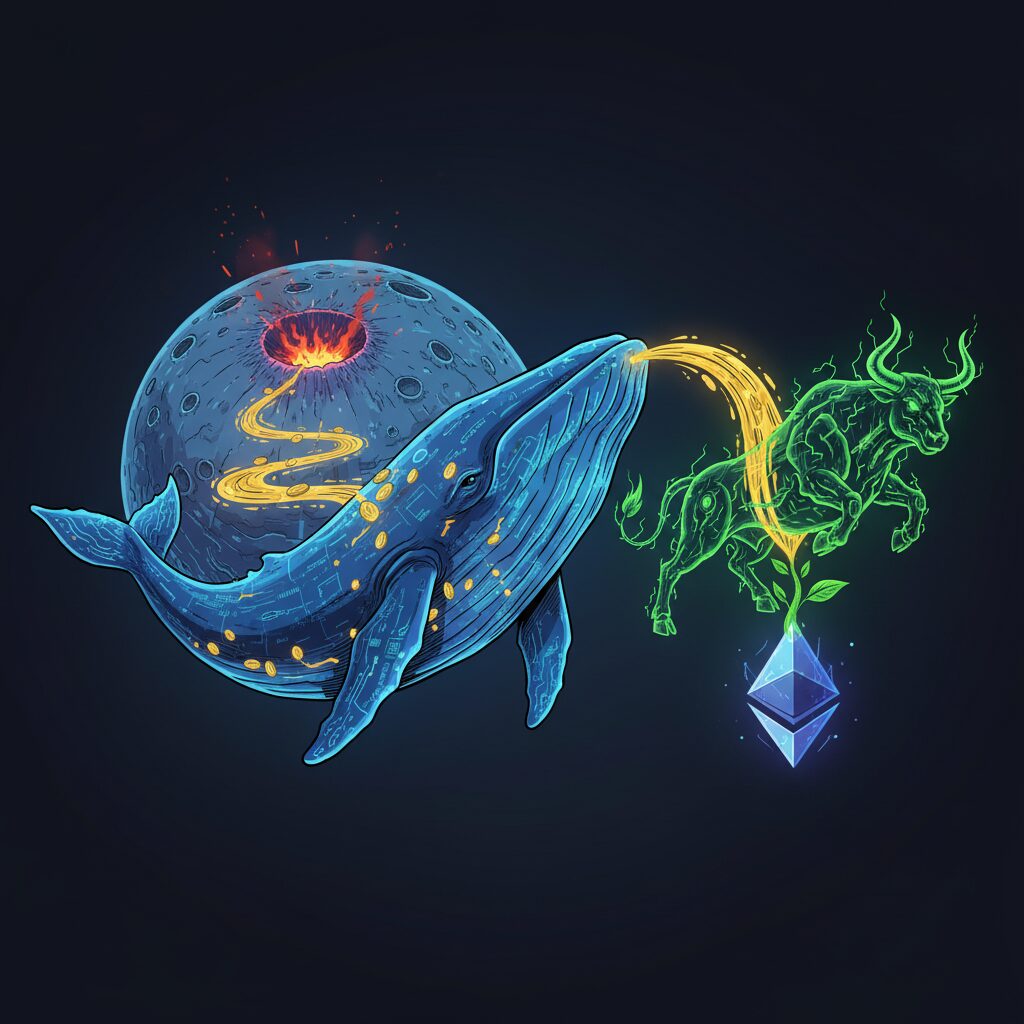

Whale Who Netted $200M in Market Crash Bets $44.5 Million on Ethereum Rebound

An anonymous trader on the Hyperliquid platform, who famously earned nearly $200 million by shorting the October 10 market crash, has reversed course with a major bullish bet on Ethereum. The trader, known in the community as the “OG Whale,” has now established a long position in ETH worth $44.5 million.

According to blockchain analytics firm Arkham Intelligence, the whale expanded an existing long by adding another $10 million on Monday. The firm noted that the position was already profitable by over $300,000 within the first hour. This trader has built a strong reputation for accurately timing significant market swings, previously capitalizing on a series of successful shorts throughout October and November.

A Mysterious Identity and Market-Wide Ripples

While the wallet’s owner remains unconfirmed, on-chain investigators have linked it to Garret Jin, the former CEO of the crypto exchange BitForex. Jin has publicly denied owning the wallet but admitted to knowing the individual responsible for the trades. The whale’s substantial long position comes as Ether trades near $2,900, showing a modest 2% gain over the past day amid a wider market recovery.

The move coincides with commentary from other major industry figures. Former BitMEX CEO Arthur Hayes suggested that Bitcoin’s recent dip to $80,500 likely marked a local bottom for this cycle. In a post on X, Hayes pointed to the anticipated end of the Federal Reserve’s quantitative tightening program as a key catalyst. With the Fed expected to stop shrinking its balance sheet next month, Hayes believes liquidity should improve for risk assets like cryptocurrencies.

Macro Uncertainty Fuels Volatility

Hayes expects Bitcoin to trade below $90,000 in the immediate future but maintains that the $80,000 level will likely hold. The market’s direction has been complicated by rapidly changing expectations for the Federal Reserve’s December meeting. The CME FedWatch Tool now indicates a 79% probability of a quarter-point rate cut, a sharp increase from 42% just one week prior.

This fluctuation caught the attention of economist Mohamed El-Erian, who described the whiplash in rate expectations as “stunning.” He noted that such volatility is the opposite of the stability the Fed typically aims for, attributing it to data disruptions and uncertainty surrounding the central bank’s leadership. For now, the crypto market is caught between this unsettled macroeconomic backdrop, shifting liquidity trends, and massive, directional bets from influential traders.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice, investment advice, or any other sort of advice. You should not treat any of the website’s content as such. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.