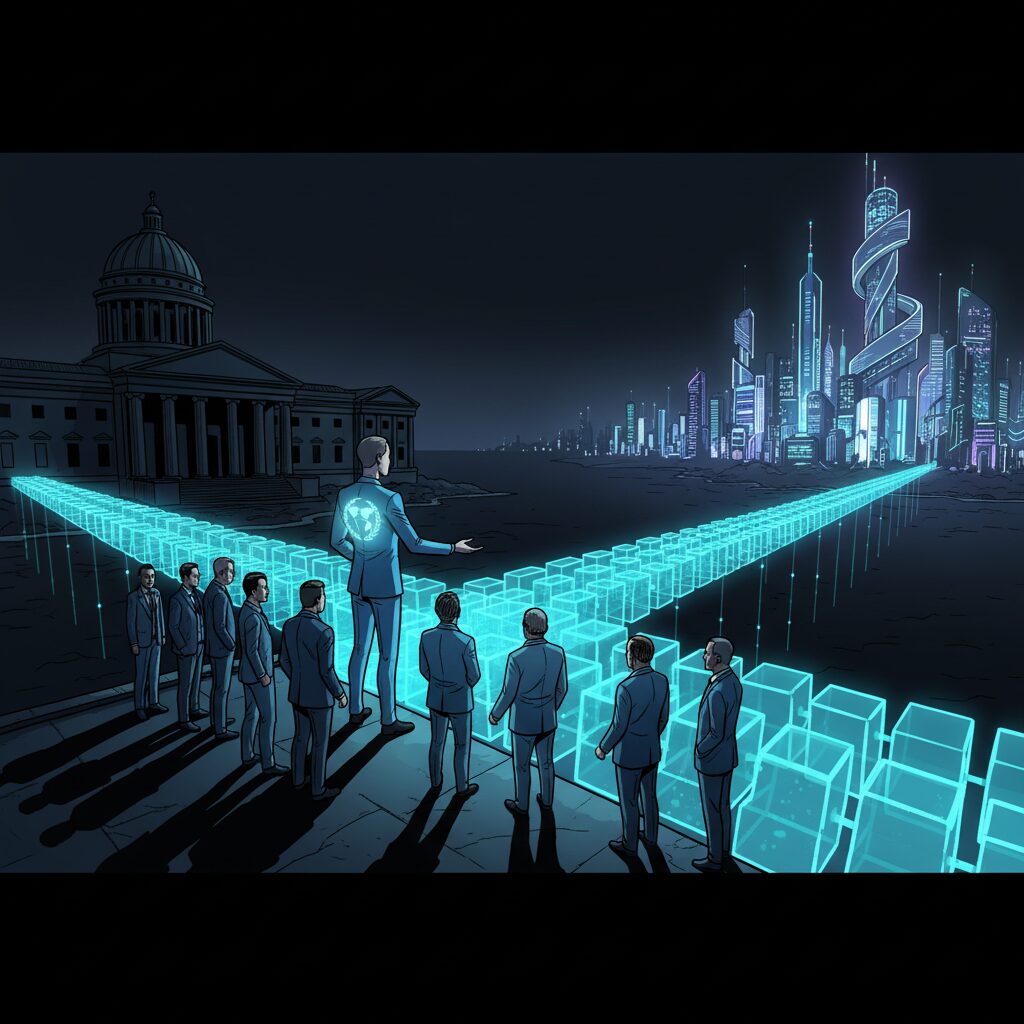

UN Development Programme to Guide Governments on Blockchain Adoption

The United Nations Development Programme (UNDP) is set to launch two major initiatives designed to help governments worldwide understand and implement blockchain technology. The plans include a specialized education program for public officials and the formation of a global blockchain advisory body.

Robert Pasicko, head of the UNDP’s financial technology team AltFinLab, confirmed the upcoming programs from the UN City offices in Copenhagen. He explained that these efforts build upon the UNDP’s existing blockchain academy, which was initially created for its own staff, and will now be expanded to support governments in deploying real-world applications.

Training and Real-World Implementation

The new government-focused academy is expected to begin operations within weeks, initially selecting four nations to work with. Pasicko anticipates formal approval for the initiative shortly, emphasizing that the program goes beyond simple training. The UNDP will also provide hands-on support to help guide projects from concept to development.

According to Pasicko, research conducted by the UNDP has already identified 300 potential use cases for governments that are prepared to adopt blockchain technology, highlighting the vast scope for its application in the public sector.

A Global Blockchain Advisory Group

In addition to education, the UNDP is developing a blockchain advisory organization. The concept was discussed during a UN general assembly in New York with representatives from 25 leading blockchain organizations, including the Ethereum Foundation, Stellar Foundation, and Polygon Labs. Pasicko suggested that if all proceeds as planned, this advisory group could be operational in the next two to three months.

The UNDP already has active pilot programs in 20 countries focused on improving financial inclusion. One key partner is Decaf, a crypto-based payment system that allows individuals to access financial services without relying on traditional banks. “How much longer do you need ordinary banks if you can bypass them with such apps?” Pasicko remarked.

The Future of Banking Infrastructure

Pasicko compared the potential decline of current banking infrastructure to that of public phone booths, which have become largely obsolete. He noted that while some have been repurposed, like those in Japan that now serve as WiFi hotspots, their original function is gone. “The same question is, do you need ATMs in a few years? I don’t think so,” he stated.

He predicts this shift won’t be driven by a single technology but by a combination of cryptocurrencies, private stablecoins, and central bank digital currencies. Different regions will likely favor different solutions, but the underlying technology makes many intermediaries unnecessary. “You need an internet connection, you need your smartphone. There is nothing else you need for these transactions,” he said.

However, Pasicko also offered a note of caution, acknowledging that established powers will try to maintain their control. He compared blockchain to fire—a tool that can be used for good or ill. Depending on how it’s deployed, he concluded, the technology could either serve the masses or widen the divide between the powerful and everyone else.