Trump’s CFTC Nominee Could Reshape Crypto Regulation and Boost XRP

President Trump’s nomination of pro-crypto advocate Michael Selig to lead the Commodity Futures Trading Commission (CFTC) signals a potential shift in the U.S. regulatory landscape for digital assets. Selig’s appointment is seen by many in the industry as a move that could provide clearer rules and foster innovation, with particular implications for XRP.

A Pro-Innovation Agenda for US Markets

Upon his nomination, Selig expressed his commitment to advancing American financial markets. “I pledge to work tirelessly to facilitate well-functioning commodity markets, promote freedom, competition and innovation, and help the President make the United States the crypto capital of the world,” he stated.

The nomination received strong backing from White House AI and crypto czar David Sacks. He described Selig as “deeply knowledgeable about financial markets and passionate about modernizing our regulatory approach.” Sacks also highlighted Selig’s extensive background, noting his experience as chief counsel of the Securities and Exchange Commission (SEC) Crypto Task Force and his previous work at the CFTC under Chairman Chris Giancarlo.

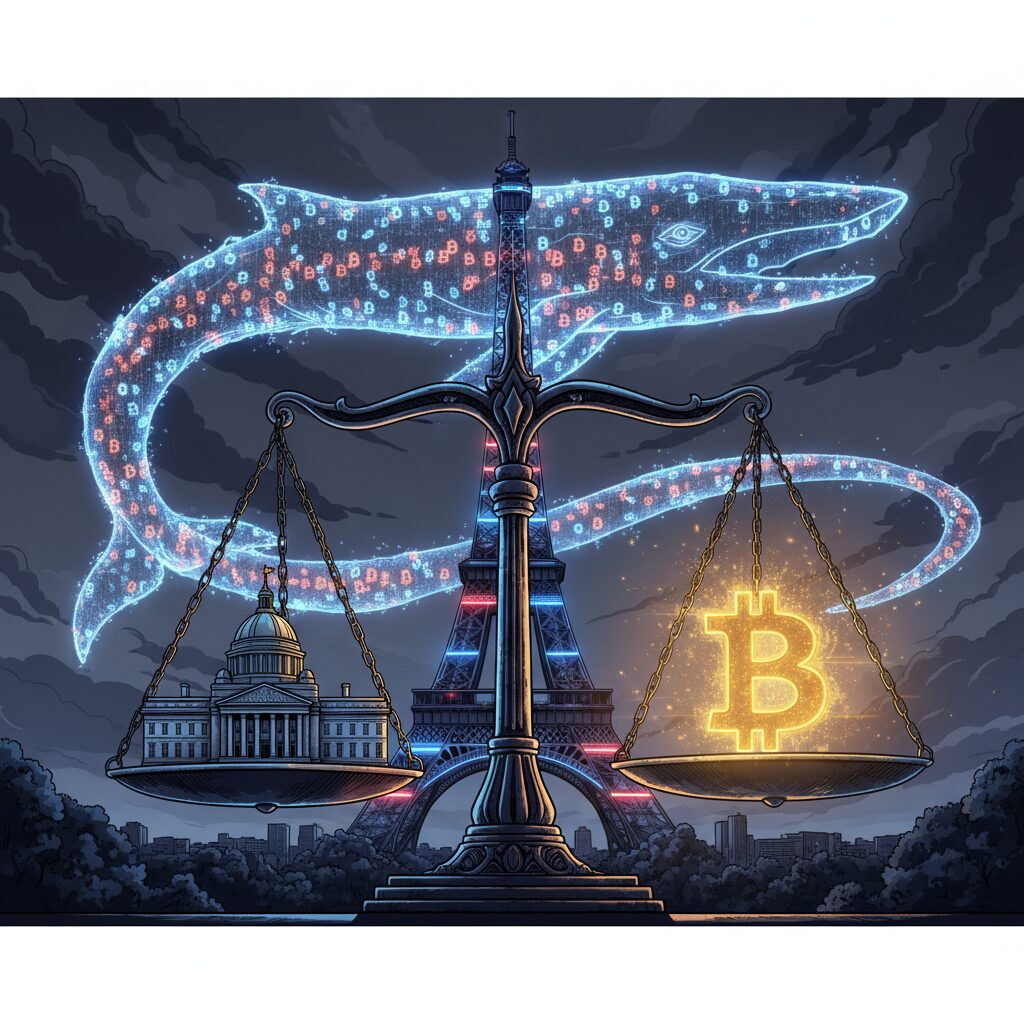

Clarifying XRP’s Legal Standing

Selig has a history of providing crucial clarity on one of the industry’s most-watched legal battles: the SEC’s case against Ripple Labs. He has consistently worked to correct misinterpretations of Judge Analisa Torres’s ruling on the legal status of XRP. In a July 2023 social media post, Selig explained that the court did not find XRP itself to be a security.

“Judge Torres held that XRP itself is not a security, but it can be sold as part of a security,” he wrote. To clarify the distinction, he compared the digital asset to traditional commodities. “XRP itself is simply computer code. A fungible commodity, like gold or whiskey—both of which can also be sold as part of investment schemes that implicate securities laws.”

He also pointed to the case’s financial outcome as a sign of the SEC’s overreach, noting that the agency “asked for $2 billion in monetary penalties from Ripple and got $125 million.” Selig argued that the ruling exposed a “massive regulatory gap” concerning digital assets, one that would require new legislation to resolve.

Looking ahead, Selig’s past comments suggest a potential path for new investment products. In August 2023, he predicted that the Ripple decision would pave the way for XRP exchange-traded fund (ETF) filings. His potential leadership at the CFTC could now be instrumental in turning that prediction into a reality.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice, investment advice, or any other sort of advice. You should not treat any of the website’s content as such. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.