Tether Invests in Ledn to Expand Bitcoin-Backed Lending Market

Ledn’s Impressive Growth

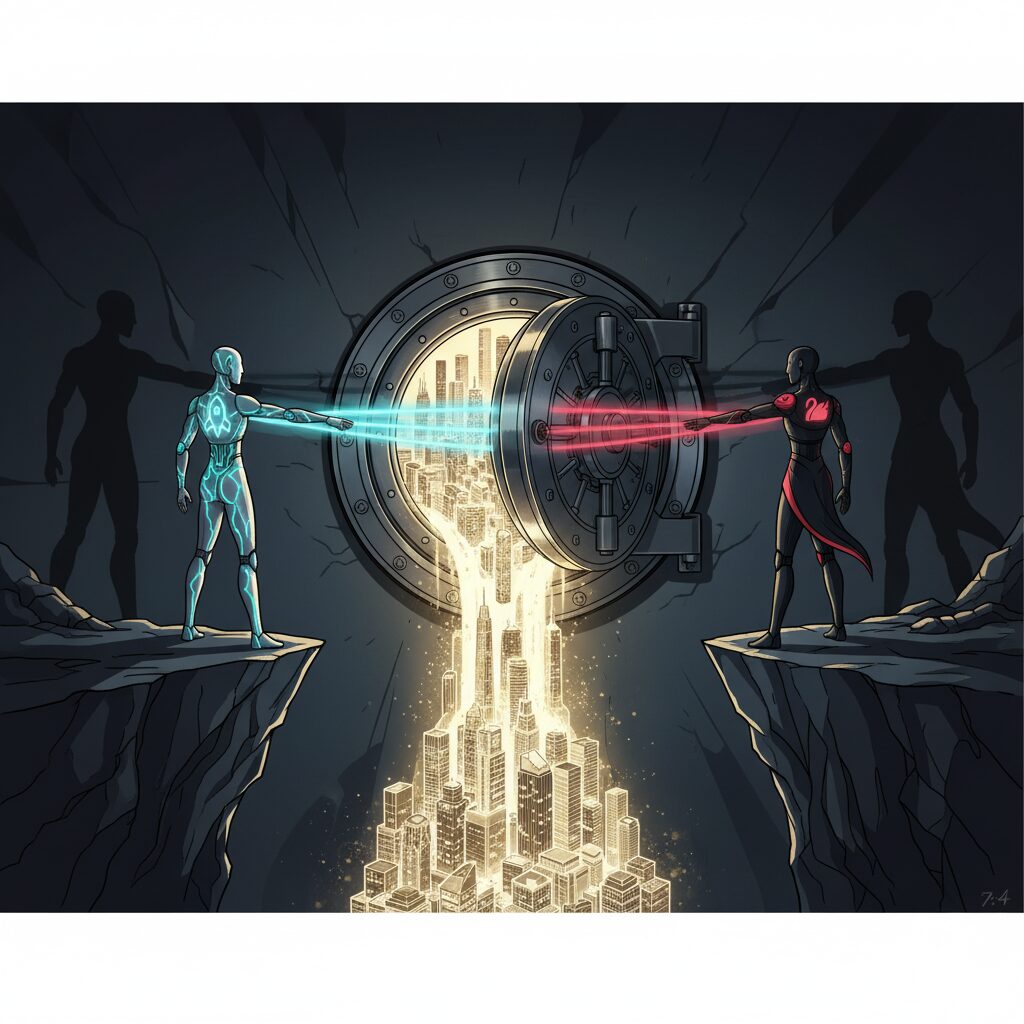

In a strategic move to broaden the market for bitcoin-backed credit, Tether has invested in the lending platform Ledn. The partnership aims to give individuals and businesses access to loans without forcing them to sell their digital assets. The size of the investment was not disclosed.

Ledn has established a significant presence in the crypto lending space, originating over $2.8 billion in bitcoin-backed loans since its inception. The company has seen accelerated growth this year, processing more than $1 billion in loans so far. Its third quarter was particularly strong, with a record $392 million in loan originations and over $100 million in annual recurring revenue.

By allowing borrowers to use bitcoin as collateral, the platform provides a way to access liquidity while preserving long-term holdings. Tether CEO Paolo Ardoino stated that this approach enhances self-custody and financial resilience, creating practical use cases that support digital assets as key components of a more inclusive financial system.

Navigating a Turbulent Market

The crypto lending sector faced a crisis of confidence in 2022 following the high-profile bankruptcies of major firms like BlockFi, Celsius, Genesis, and Voyager Digital. The collapse of these centralized services left many questioning the viability and safety of such platforms.

According to Ledn co-founder Mauricio Di Bartolomeo, the company navigated this challenging period thanks to a robust risk management program and a focus on client asset security. The firm emphasizes its simple and transparent operating model, which includes maintaining a fully collateralized loan book and conducting regular third-party Proof of Reserves attestations through regulated entities.

Future of Crypto-Backed Credit

Tether’s investment arrives as the broader market for crypto-collateralized loans shows signs of significant expansion. A report from Data Intelo projects that the sector could grow from an estimated $7.8 billion in 2024 to over $60 billion by 2033. This growth is expected to be fueled by rising demand for alternative credit solutions that leverage digital assets.

Ledn’s co-founder and CEO, Adam Reeds, expressed confidence that demand for bitcoin financial services will continue to increase. He noted that the collaboration with Tether positions Ledn to lead the market as it evolves and matures.