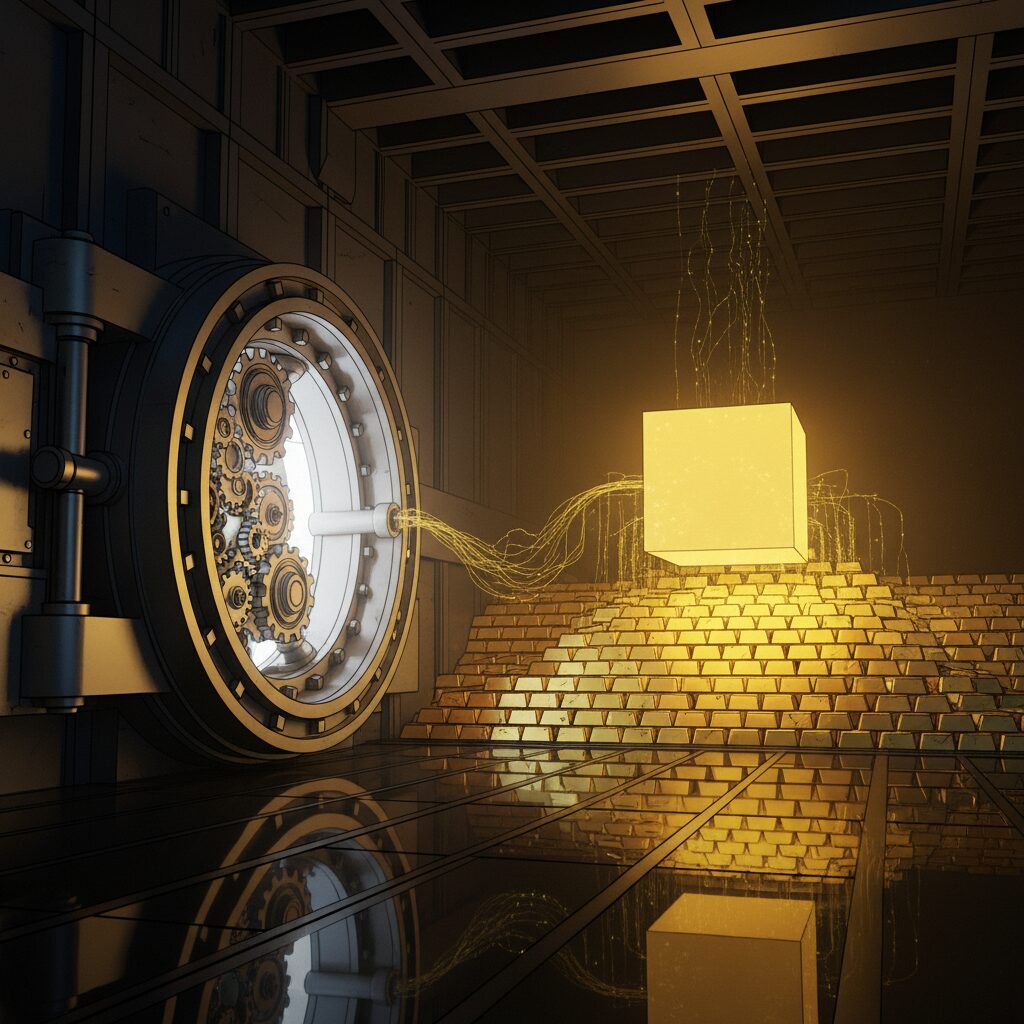

Tether Gold Report Confirms Full Backing as Market Cap Tops $2.1 Billion

Tether has published its third-quarter 2025 attestation report for its gold-backed token, Tether Gold (XAUT), confirming that each token is fully backed by physical gold bullion held in Switzerland.

Report Details and Reserves

The report, prepared by El Salvador-based TG Commodities SA de CV, detailed that as of September 30, Tether’s reserves consisted of 375,572 ounces of pure gold. Based on the reference price at the end of the quarter, this amount was valued at approximately $1.44 billion. The data also showed 522,089 XAUT tokens in circulation, with another 139,751 available for issuance.

Driven by a recent surge in gold prices, XAUT’s market capitalization has climbed to $2.1 billion. This represents a significant increase, more than doubling from its valuation of less than $850 million in August.

Market Growth and Tokenization Trends

Tether CEO Paolo Ardoino commented on the milestone, stating that Tether Gold proves real-world assets can successfully operate on-chain without compromise. He noted that record gold prices combined with growing institutional interest in tokenization create a major opportunity for XAUT.

Together with its main competitor, PAX Gold, Tether Gold dominates the tokenized gold market, accounting for 90% of the sector’s $3.7 billion total value. XAUT has established itself as one of the largest Real-World Asset (RWA) products on the blockchain. The tokenization trend is also drawing attention from regulators, with U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce recently stating that it has become a “major focus” for the agency.