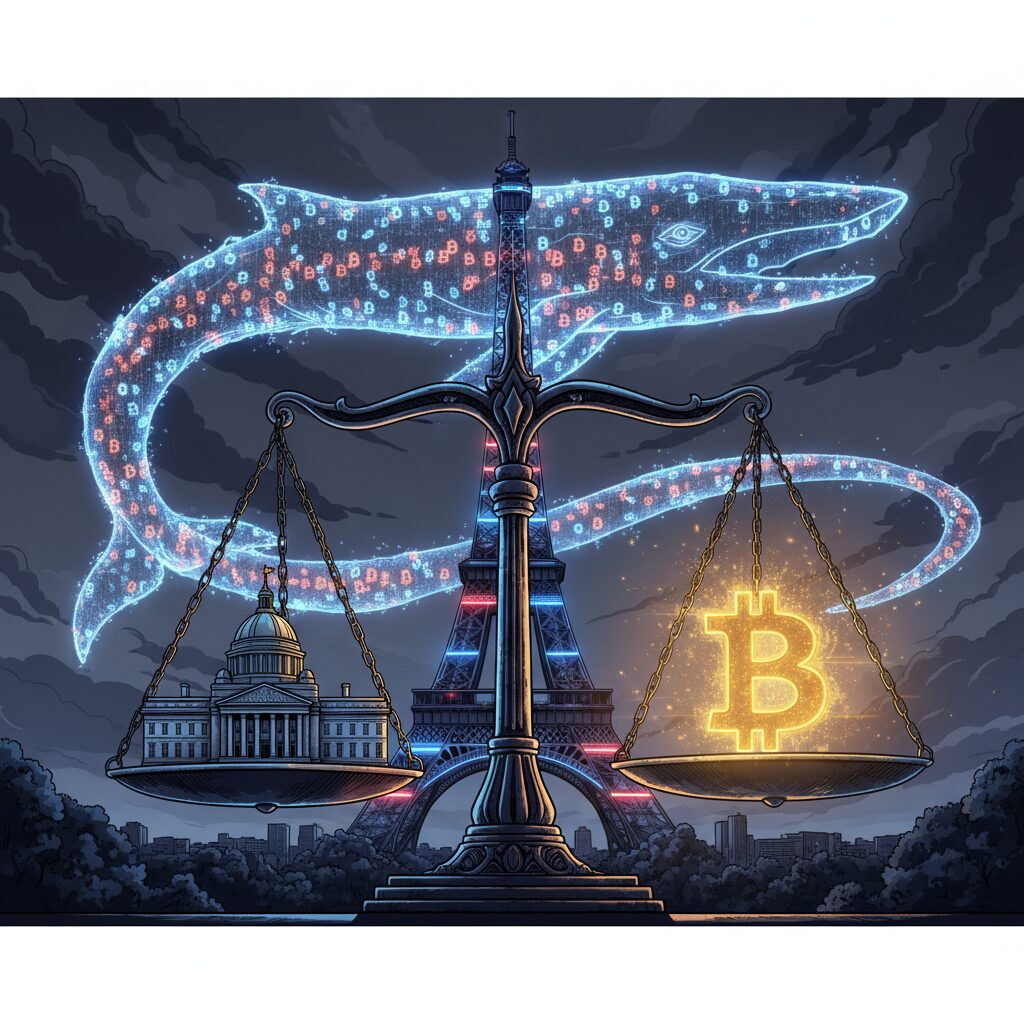

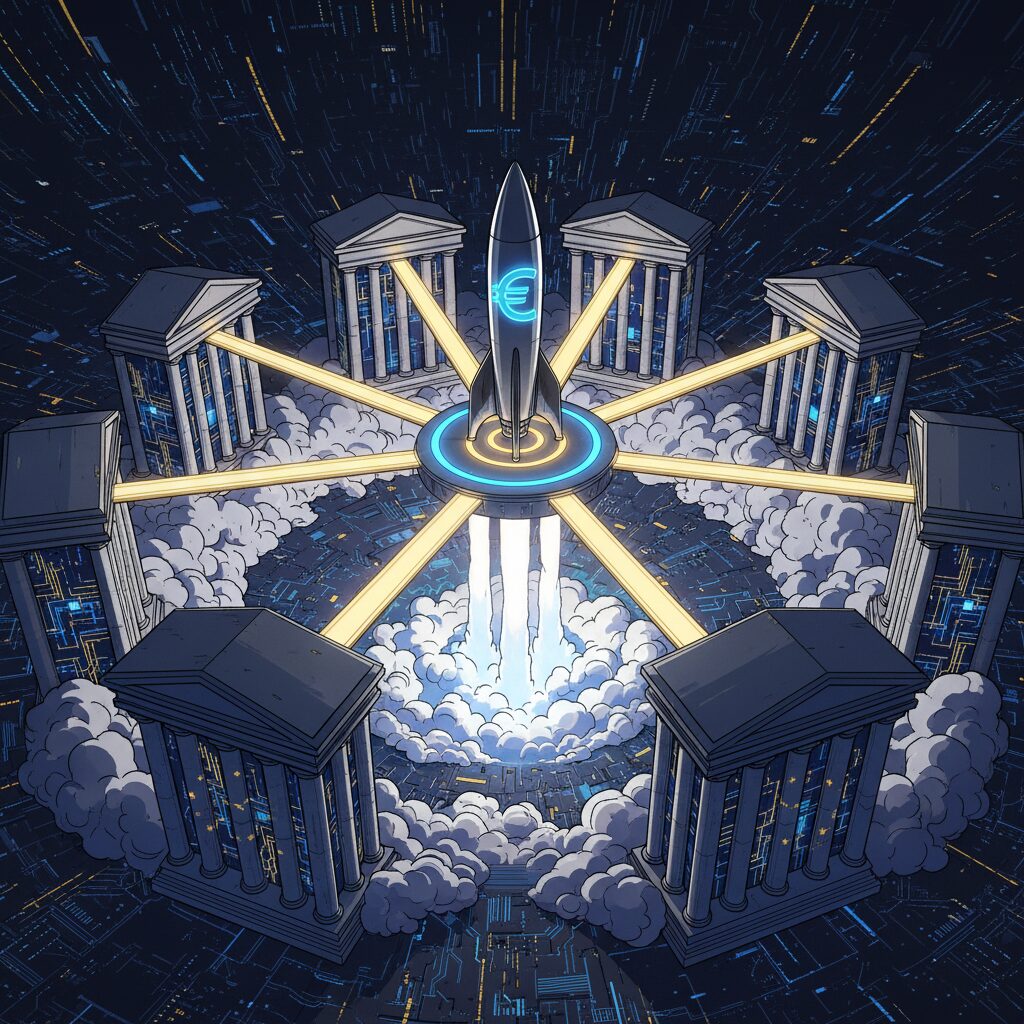

Ten EU Banks Form Alliance to Launch Euro Stablecoin by 2026

Consortium Aims to Counter US Dollar Dominance in Digital Payments

A group of ten major European banks, including BNP Paribas, ING, and UniCredit, has formed a consortium to launch a euro-backed stablecoin. The initiative, managed by a new Amsterdam-based entity called Qivalis, aims to introduce the digital payment instrument by mid-2026 and challenge the overwhelming dominance of US dollar-denominated tokens in the global stablecoin market.

The move is a direct response to the current market landscape, where dollar-pegged stablecoins account for over 99% of a market valued at more than $300 billion. In contrast, euro-pegged alternatives have a circulation of just $649 million, a disparity that has raised concerns among European regulators about the bloc’s monetary autonomy.

The consortium also includes CaixaBank, Danske Bank, SEB, Raiffeisen Bank International, Banca Sella, KBC, and DekaBank. The group has already applied for an electronic money institution license with the Dutch Central Bank and plans to operate in full compliance with the EU’s Markets in Crypto-Assets (MiCA) regulation.

Experienced Leadership to Steer Qivalis

Qivalis has appointed a team of seasoned financial and regulatory experts to lead the project. Jan-Oliver Sell, former Managing Director at Coinbase Germany who secured the country’s first crypto custody license from BaFin, will serve as CEO. He is joined by CFO Floris Lugt, who previously headed Digital Assets Wholesale Banking at ING.

The Supervisory Board will be chaired by Sir Howard Davies, the former chairman of the UK’s Financial Services Authority and RBS, bringing extensive regulatory expertise to the venture. All leadership appointments are pending final regulatory approval.

Sell described the launch of a euro-denominated stablecoin backed by European banks as a “watershed moment” for the continent’s digital commerce and financial innovation. The consortium remains open for other banks to join, aiming to foster broad industry participation.

Project Follows Warnings of Systemic Risk

The banking initiative comes after repeated warnings from top European financial authorities about the systemic risks posed by a heavy reliance on foreign stablecoins. Dutch central bank governor Olaf Sleijpen has cautioned that the rapid growth of these tokens could eventually force the European Central Bank (ECB) to adjust monetary policy if market instability were to trigger a mass sell-off of their underlying assets, which are primarily U.S. Treasuries.

In October, the European Systemic Risk Board, chaired by ECB President Christine Lagarde, highlighted vulnerabilities in stablecoin models that could expose the EU to offshore liabilities during market stress. European Stability Mechanism Managing Director Pierre Gramegna echoed these concerns, stating that Europe should not be dependent on dollar-denominated stablecoins.

A Dual Approach to Modernizing Payments

The consortium’s stablecoin is designed to enhance Europe’s payment infrastructure by enabling 24/7 access to efficient cross-border transactions, programmable payments, and improved settlements for digital assets. According to Lugt, an industry-wide approach is essential for banks to adopt the same high standards for this new payment technology.

This private-sector effort runs parallel to the ECB’s own work on a digital euro. ECB Executive Board member Piero Cipollone recently suggested that a public digital currency could realistically launch around 2029. Together, these initiatives represent a dual approach by Europe to modernize its financial systems and assert greater control over its digital economic future.