Tea-Fi Aims to Simplify DeFi with a Multi

A new platform named Tea-Fi is entering the Decentralized Finance (DeFi) space with the goal of lowering the barrier to entry for users. By integrating multiple functions into a single interface, the project seeks to address common challenges like fragmented liquidity and complex user experiences. According to project data, Tea-Fi has already processed over $650 million in transaction volume across more than one million connected wallets.

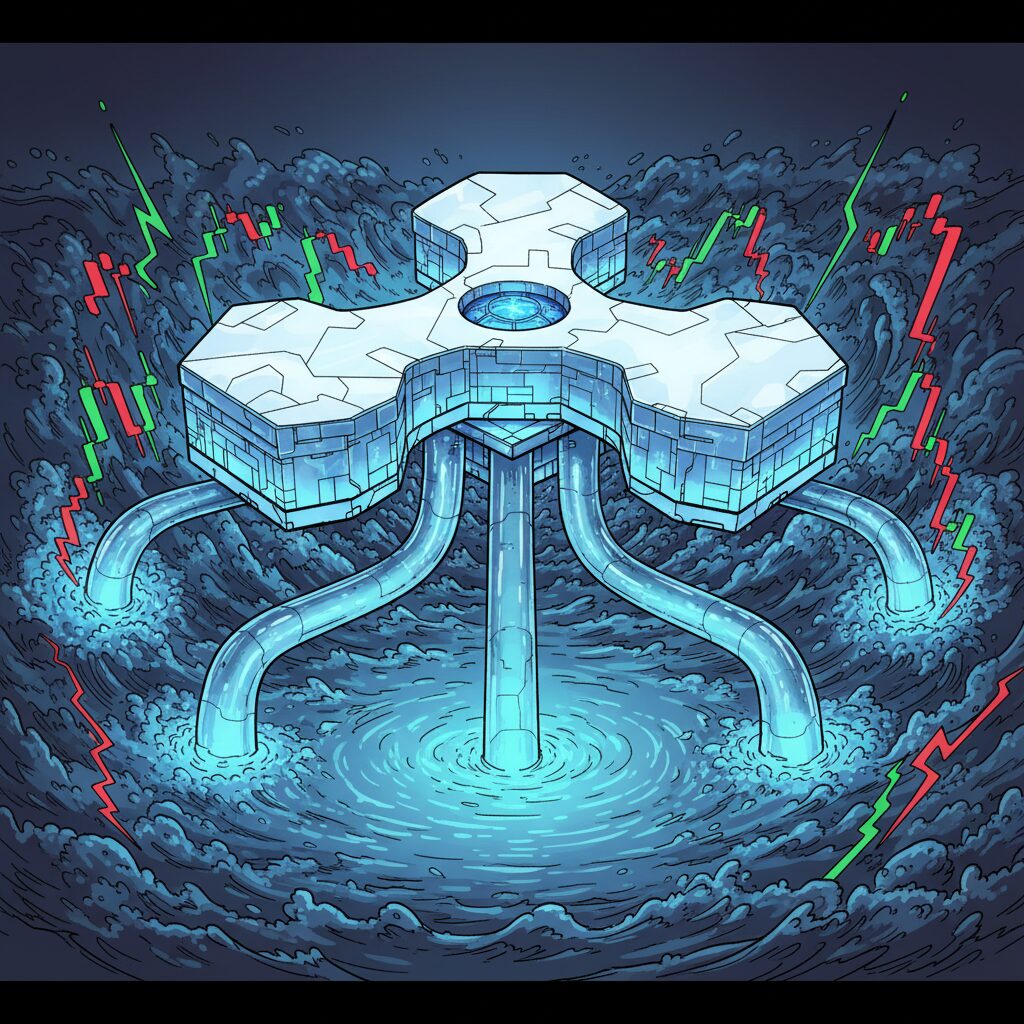

At the heart of the ecosystem is the $TEA token, which is designed to support a self-sustaining network based on protocol revenue and shared value. This system is powered by a perpetual rewards engine called the TeaPOT.

Key Features of the Tea-Fi Platform

Tea-Fi’s approach centers on abstracting away the technical complexities of DeFi. It allows users to interact with over 40 blockchains without managing multiple bridges or holding native gas tokens. The platform’s core innovations include a protocol-owned liquidity vault, known as the TeaPOT, which captures platform fees and partner revenues. These funds are then used for $TEA token buybacks, user rewards, and ecosystem development, creating a yield model based on actual protocol revenue rather than token emissions.

The platform also features SuperSwap, a tool for executing cross-chain swaps and bridging assets in a single transaction. To further streamline the user experience, its Easy-Gas feature allows transaction fees to be paid in stablecoins or other supported tokens, effectively creating a gasless environment. Users retain full control of their assets through a self-custodial smart wallet, and a planned TeaCard will allow for real-world spending of crypto assets.

The ecosystem is also designed to be extensible through Protocol-Aligned Apps (PAAs). These third-party decentralized applications can integrate directly with Tea-Fi, contributing to protocol revenue and expanding the platform’s utility.

The Role of the $TEA Token

The $TEA token is central to Tea-Fi’s circular economic model, where all platform activity contributes to its value. The token serves three main functions: utility for powering yield and staking systems, governance rights through a locked version called vTEA, and a value capture mechanism that directs protocol revenue back into the ecosystem.

This design aims to create a deflationary token economy where value is driven by platform usage rather than speculation.

Project Growth and Upcoming Launch

Tea-Fi has reported significant traction, citing over two million connected wallets, 20 million transactions, and a Total Value Locked (TVL) exceeding $5 million. The project’s growth has been supported by integrations with partners including Polygon Labs, Katana, and NOGA.

The next major step for the project is its Token Generation Event (TGE), which is scheduled for 12:00 PM UTC on November 3, 2025. The $TEA token is expected to be listed on Kraken, Kucoin, and MEXC, which will activate the governance and yield participation features for token holders.