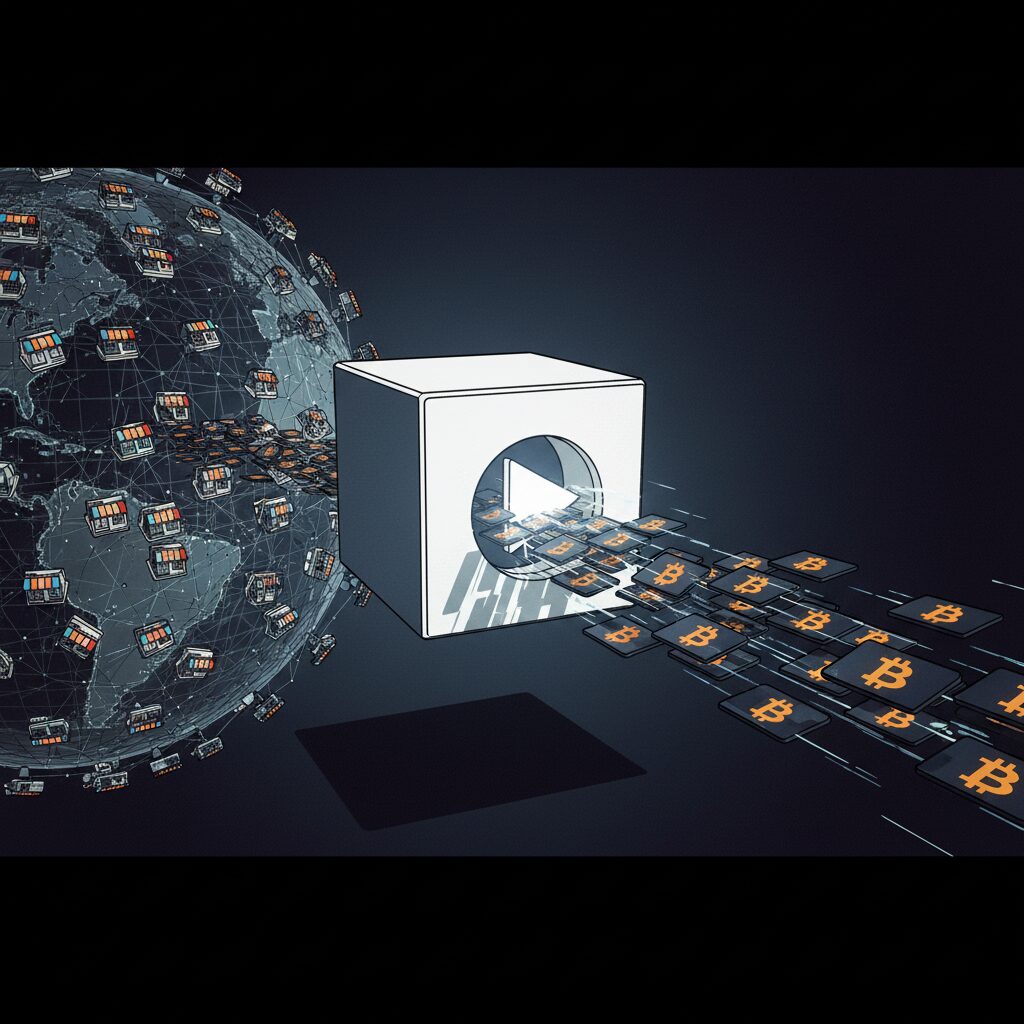

Square Rolls Out Bitcoin Payments for 4 Million Merchants Globally

Block’s payment processor, Square, has officially launched its Bitcoin payment feature, enabling approximately four million merchants to accept Bitcoin at checkout. The new system leverages the Lightning Network to offer fast, low-cost transactions and will waive all transaction fees until 2027.

A Major Step for Merchant Adoption

Announced by Block co-founder Jack Dorsey on November 10, the feature allows sellers to accept payments through their existing Square point-of-sale terminals. The system is highly flexible, supporting four distinct payment configurations: Bitcoin to Bitcoin, Bitcoin to fiat, fiat to Bitcoin, or fiat to fiat. This gives merchants control over how they manage their funds.

Initially, the service is available for in-person purchases across eight countries, including the United States, United Kingdom, France, and Japan. According to Jacob Szymik, an account executive at Square, options for online and invoicing payments are already in development and will be released soon.

Zero Fees and Lightning-Fast Transactions

To incentivize adoption, Square will not charge any transaction fees for Bitcoin payments until 2027, after which a flat 1% fee will apply. This presents a significant cost-saving opportunity compared to traditional credit card processing fees, which typically range from 1.5% to 4%.

The system’s efficiency is powered by the Bitcoin Lightning Network, a second-layer solution designed for rapid settlements and minimal fees. This allows businesses to reduce processing costs without sacrificing quick access to their cash flow. Early adopters have already reported successful transactions, with Parker Lewis of Zaprite and Katie Ananina of CitizenX both using the feature at a Texas coffee shop shortly after its launch.

Mapping the Growing Bitcoin Economy

Alongside the payment feature, Block introduced a live map within its Cash App that displays all merchants worldwide accepting Bitcoin, including those using competing payment systems. Dorsey encouraged users to persuade local Square merchants to enable the feature and consider keeping their earnings in Bitcoin rather than converting to fiat currency.

This initiative aligns with growing consumer interest in cryptocurrency for everyday transactions. A July YouGov survey of 1,000 participants in the US and UK found that 37% view payments as a primary use case for digital assets. Miles Suter, Block’s Head of Bitcoin Product, stated that the platform makes Bitcoin payments as seamless as traditional card payments, giving small businesses access to financial tools once reserved for large corporations.