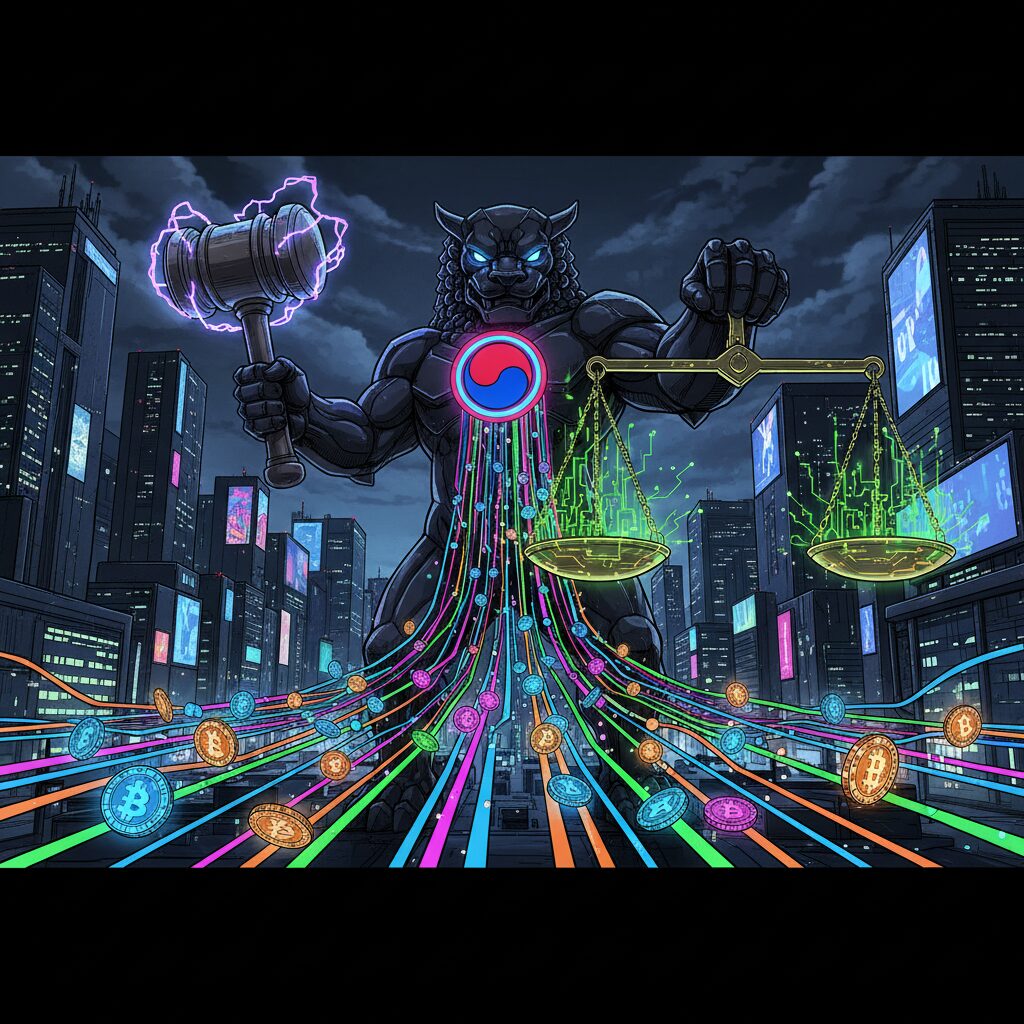

South Korea Intensifies Crypto Oversight with Expanded Travel Rule

South Korea is set to implement one of its most significant Anti-Money Laundering (AML) crackdowns by expanding its crypto Travel Rule to include transactions under 1 million won, or about $680. The move signals a broader government effort to close loopholes that could be exploited for illicit financial activities.

The plan was revealed by Lee Eok-won, chairman of the country’s Financial Services Commission (FSC), during a session with the National Assembly’s Legislation and Judiciary Committee. He confirmed that the government intends to vigorously pursue money laundering activities that leverage cryptocurrency transactions, specifically noting that the Travel Rule’s expansion is a key part of this strategy.

Tax Authorities to Target Offline Wallets

In a related enforcement push, the National Tax Service (NTS) is preparing to take aggressive measures against tax delinquents suspected of concealing their crypto assets offline. An NTS official stated the agency is ready to conduct home searches to confiscate cold wallets and hard drives if owners are believed to be hiding funds to avoid taxes.

The NTS plans to use specialized crypto-tracking programs to analyze the financial histories of individuals with outstanding tax liabilities. If the analysis suggests that assets are being concealed on offline devices, authorities will be authorized to search the premises and seize the hardware.