SharpLink Deploys $200 Million in ETH on Linea to Optimize Treasury

A Strategic Shift to Layer 2

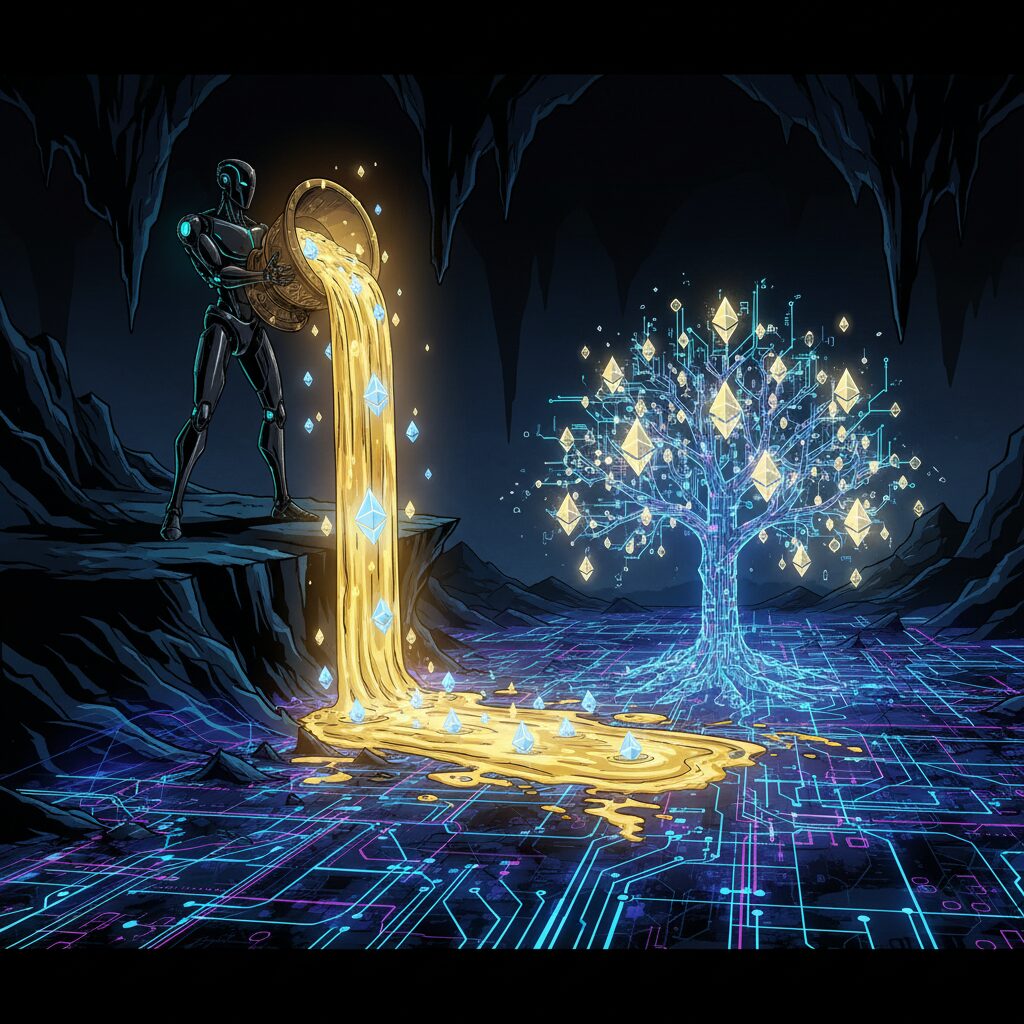

In a significant move for institutional asset management, Ethereum treasury firm SharpLink has deployed $200 million worth of ETH on Linea, a Layer 2 scaling solution. The decision is part of a broader strategy to streamline treasury operations, improve security, and significantly reduce the high transaction fees associated with operating directly on Ethereum’s main network.

This transfer underscores a growing trend where institutions are leveraging Ethereum’s Layer 2 ecosystems to achieve greater capital efficiency. As gas fees on the main blockchain can become prohibitive during periods of high network activity, L2 platforms like Linea offer a compelling alternative with faster and more affordable transactions.

Why Linea? Speed, Cost, and Compatibility

Developed by Consensys, Linea is engineered for scalability without compromising the core principles of decentralization. The network utilizes zero-knowledge rollups (zk-rollups), a technology that bundles large batches of transactions together and settles them as a single entry on the Ethereum mainnet. This process enables near-instant transaction finality at a fraction of the cost.

By moving a substantial portion of its treasury to Linea, SharpLink is signaling its confidence in a future where high-value institutional operations can thrive in more efficient environments. Critically, this is achieved without forgoing the robust security guarantees of the underlying Ethereum blockchain. Linea also offers seamless compatibility with existing Ethereum infrastructure, allowing firms like SharpLink to transition their operations without a complete systems overhaul.

Growing Institutional Interest in Ethereum’s L2s

SharpLink’s large-scale deployment is likely to be a bellwether, potentially inspiring other institutions to explore similar treasury strategies on Layer 2 networks. As L2 adoption continues to accelerate, more firms are recognizing the clear benefits of scalability and lower fees.

The $200 million move is more than just a financial transaction; it’s a strong vote of confidence in Ethereum’s expanding ecosystem and a clear example of how sophisticated firms are adapting their strategies to meet the demands of the modern blockchain landscape.