R2 Protocol Aims to Bridge Institutional Yield with On-Chain Finance

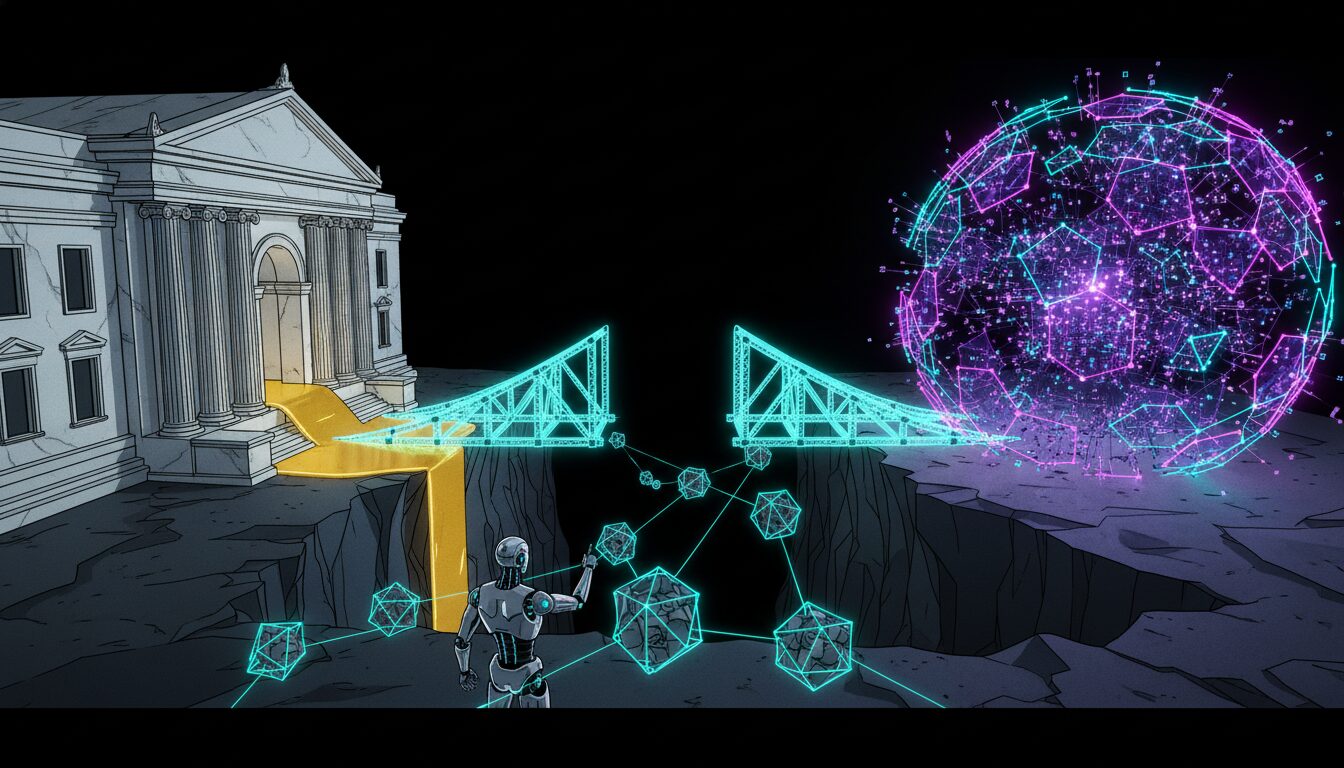

A new protocol named R2 is working to make institutional-grade income accessible to DeFi users by aggregating a diverse range of tokenized Real-World Assets (RWAs). The platform allows anyone holding USDC to tap into yields generated from a verifiable pipeline of institutional asset managers.

A Diversified and Transparent Pipeline

A core component of R2’s infrastructure is its diversified asset pipeline, which sources opportunities from more than ten verified institutional asset managers. This aggregation model is designed to mitigate the risks associated with platforms that rely on a single issuer.

The protocol’s integrated partners include Securitize, which provides access to tokenized private credit from Apollo and tokenized T-Bills from VanEck. It also features Ondo Finance’s OUSG and USDY series of tokenized U.S. Treasurys, on-chain private credit strategies from Fasanara Capital, and other regional providers like Mercado Bitcoin and Superstate. To secure these assets, R2 uses Anchorage Digital as its institutional custodian partner for asset custody and compliance.

R2 emphasizes that its entire process is verifiable. All underlying positions can be tracked on-chain, and the protocol publishes proof of yield and allocation data through an open dashboard and auditable smart contract logs.

A Self-Sustaining Ecosystem

Beyond the base yields from institutional RWAs, the protocol enhances its offerings with its own seasonal token incentive programs. R2 tokens are periodically distributed as additional rewards to early depositors and long-term liquidity contributors. The model aims to create a self-reinforcing growth loop by combining real-world yield with on-chain incentives.

R2 Protocol was also selected for the BNB Chain’s MVB10 Accelerator, where it was co-incubated by venture capital firm YZi Labs and CoinMarketCap.

“Real yield is no longer a buzzword. It is about building bridges between regulated yield and open finance,” said R2 founder Jeffrey Yang. “With more than ten institutional asset managers integrated and transparency built directly onchain, R2 makes institutional income accessible to anyone holding USDC.”

By aggregating multiple institutional sources and providing a transparent, verifiable layer, platforms like R2 Protocol are aiming to build more resilient and mature infrastructure for the RWA sector, potentially increasing user trust and stability in on-chain yield generation.