How to Vet a DeFi Insurance Provider

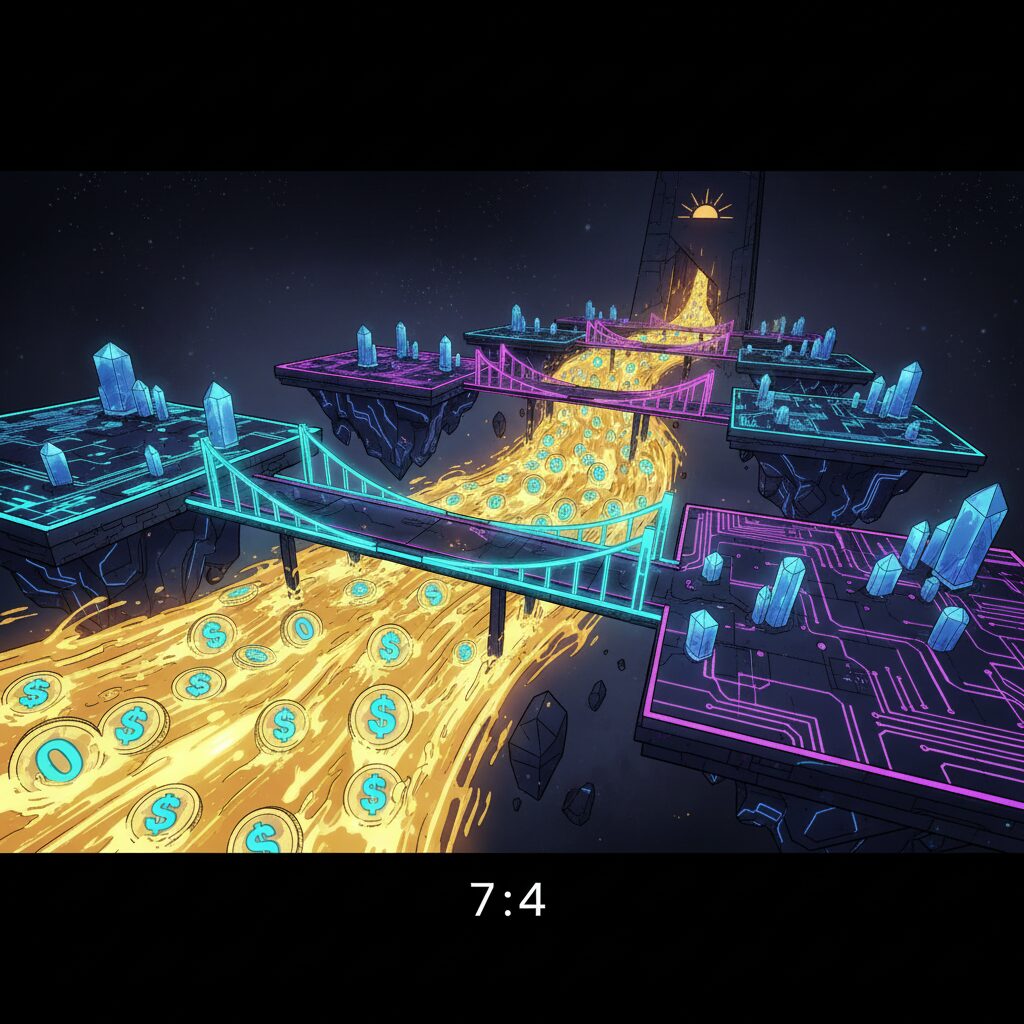

As the Decentralized Finance (DeFi) ecosystem expands, so do the inherent risks. The increasing frequency of bridge failures, protocol hacks, and stablecoin de-pegging events highlights a growing need for reliable insurance coverage. Selecting the right provider is crucial to protecting your assets.

Verifying Platform Security and Audits

A trustworthy DeFi insurer is transparent about its security practices. When evaluating a platform, look for clear documentation on its smart contract audits, reserve systems, and any bug bounty programs it runs. Reputable projects are regularly reviewed by trusted third-party auditors and make these results public.

If an insurance provider does not openly share its security information, it should be considered a significant red flag. Caution is necessary, as platforms with a proven payout history and transparent operations are generally more reliable than untested insurers with unclear policies.