Housing Crisis Pushing Young Americans to Risky Crypto Bets, Study Finds

From Down Payments to Digital Wagers

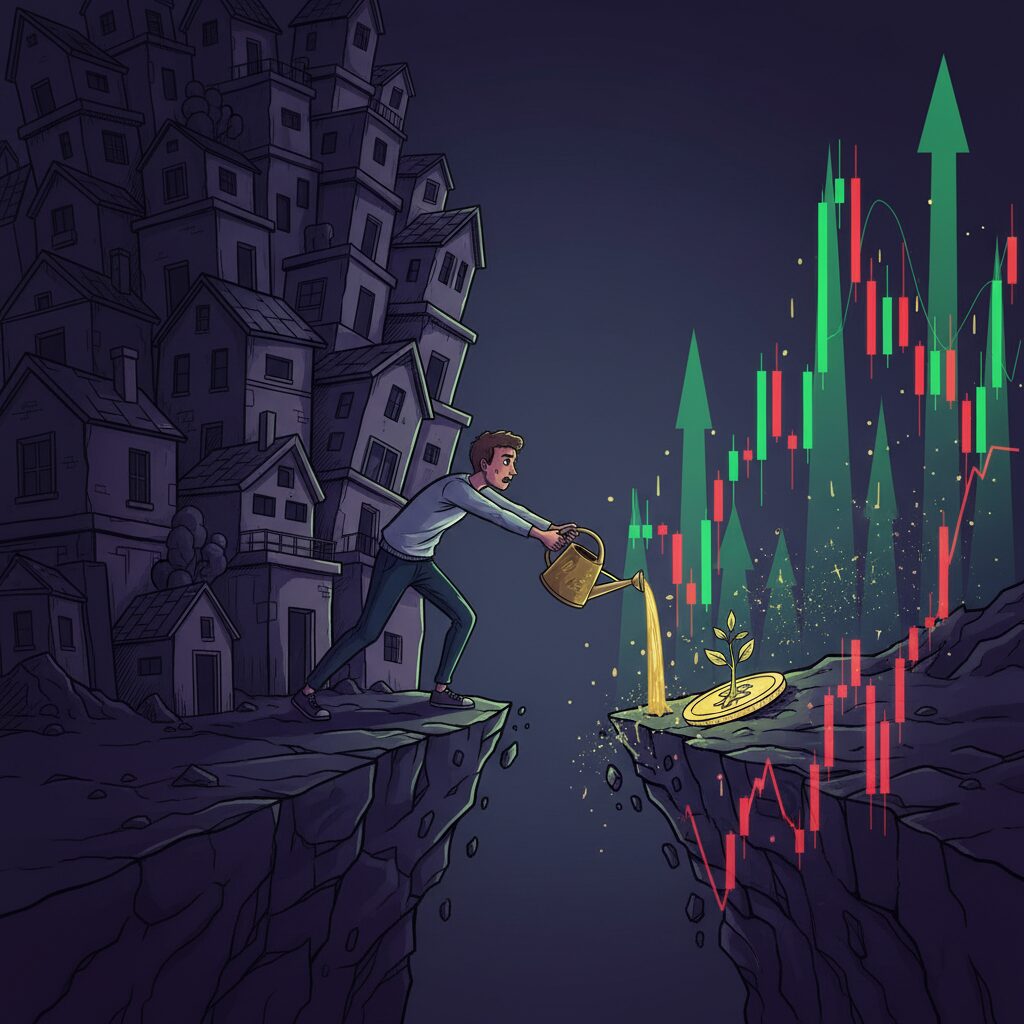

A new study suggests that as the dream of homeownership fades for many young Americans, they are increasingly turning to speculative cryptocurrency investments out of financial desperation. Researchers argue that for a growing number of “discouraged renters,” high-risk digital assets have become a substitute for traditional saving once buying a home feels impossible.

The report highlights a widening affordability gap, noting that the median U.S. house price-to-income ratio has climbed so dramatically since the 1980s that today’s young adults would need almost two additional years of income to afford a home their parents could have purchased. This economic pressure is causing a significant shift in financial behavior. Instead of saving for a down payment, many are channeling their funds into volatile assets in hopes of a life-changing return.

According to the authors, crypto has become a “substitute for the American Dream.” This participation isn’t driven by a belief in decentralization or a distrust of banks but is instead a coping mechanism for a system where conventional paths to building wealth feel broken.

The Profile of a Discouraged Renter

The study identifies a key demographic it calls “discouraged renters”—individuals who have concluded that homeownership is no longer a realistic goal. This mindset leads to lasting changes in financial habits. Compared to homeowners with a similar net worth, these renters accumulate about 10% more in credit card debt and are more likely to disengage from long-term career ambitions, a phenomenon linked to “quiet quitting.”

Participation in crypto is highest among renters with assets between $50,000 and $300,000. The report describes this group as being in a financial no-man’s-land: too well-off to give up on financial goals entirely, yet too far from being able to afford property. For them, crypto becomes a “last-chance lever” to try and beat the system. Below $50,000 in assets, investment drops off due to a simple lack of funds.

While welfare programs may soften the impact of investment losses, the study warns of a bleak long-term outcome. Over time, many discouraged renters risk falling into a near-zero wealth trap, while those who continue saving for a home steadily build their assets.

A Global Trend of Speculation

This pattern isn’t unique to the United States. Researchers note that young people in South Korea and Japan, also facing severe housing inflation, are showing similar signs of disengagement and are contributing to fast-growing crypto communities. The conclusion is that when affordable shelter becomes unattainable, speculation often replaces saving.

In a related development, the U.S. Department of Housing and Urban Development (HUD) announced in March that it is exploring the potential use of blockchain and stablecoins to enhance some of its operations. Officials discussed a pilot program that would test stablecoin payments for a HUD grantee before considering any wider implementation.