FTSE Russell Taps Chainlink to Bring Major Stock Indexes On

Global index provider FTSE Russell is partnering with Chainlink to publish its benchmark equity and digital asset indexes directly on various blockchains. The move highlights a growing trend of using blockchain technology to deliver institutional-grade market data for decentralized finance.

The collaboration will make data from key benchmarks—including the Russell 1000, Russell 2000, Russell 3000, and the FTSE 100—available through DataLink, an institutional publishing service powered by the Chainlink oracle network. These indexes are critical financial tools, with over $18 trillion in global assets benchmarked against them.

According to FTSE Russell CEO Fiona Bassett, the initiative is a strategic step toward enabling “innovation around tokenized assets” and exchange-traded funds. This isn’t the company’s first venture into the digital asset space. In January, it launched a series of crypto indexes with SonarX, and in 2023, it partnered with Grayscale to create sector-specific crypto indexes for smart contract platforms and other categories.

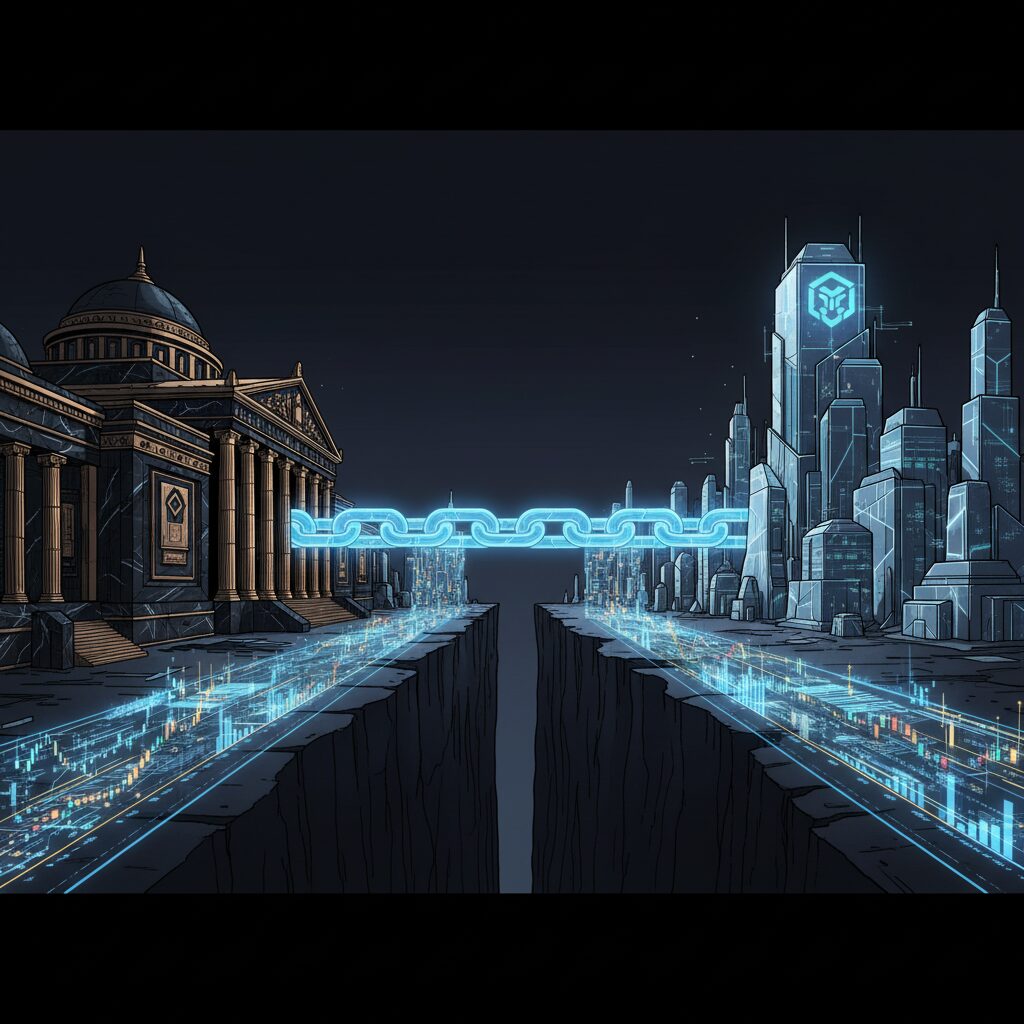

A Broader Trend of Institutional Adoption

FTSE Russell is one of several major financial institutions actively exploring blockchain for applications like tokenization, settlement, and stablecoin integration. This wider adoption signals a significant shift in how traditional finance views distributed ledger technology.

JPMorgan, for example, has expanded its tokenization efforts by bringing private equity funds on-chain through its private Kinexys blockchain. Similarly, both Goldman Sachs and BNY Mellon have started offering tokenized money market funds to clients, enabling features like 24/7 settlement and on-chain ownership tracking.

Analysts at Citigroup suggest this growing institutional interest is partly fueled by a more defined regulatory environment. In an April report, the bank noted that regulatory clarity, particularly for stablecoins in the U.S., could be the main catalyst for greater integration of blockchain technology into the existing financial system.