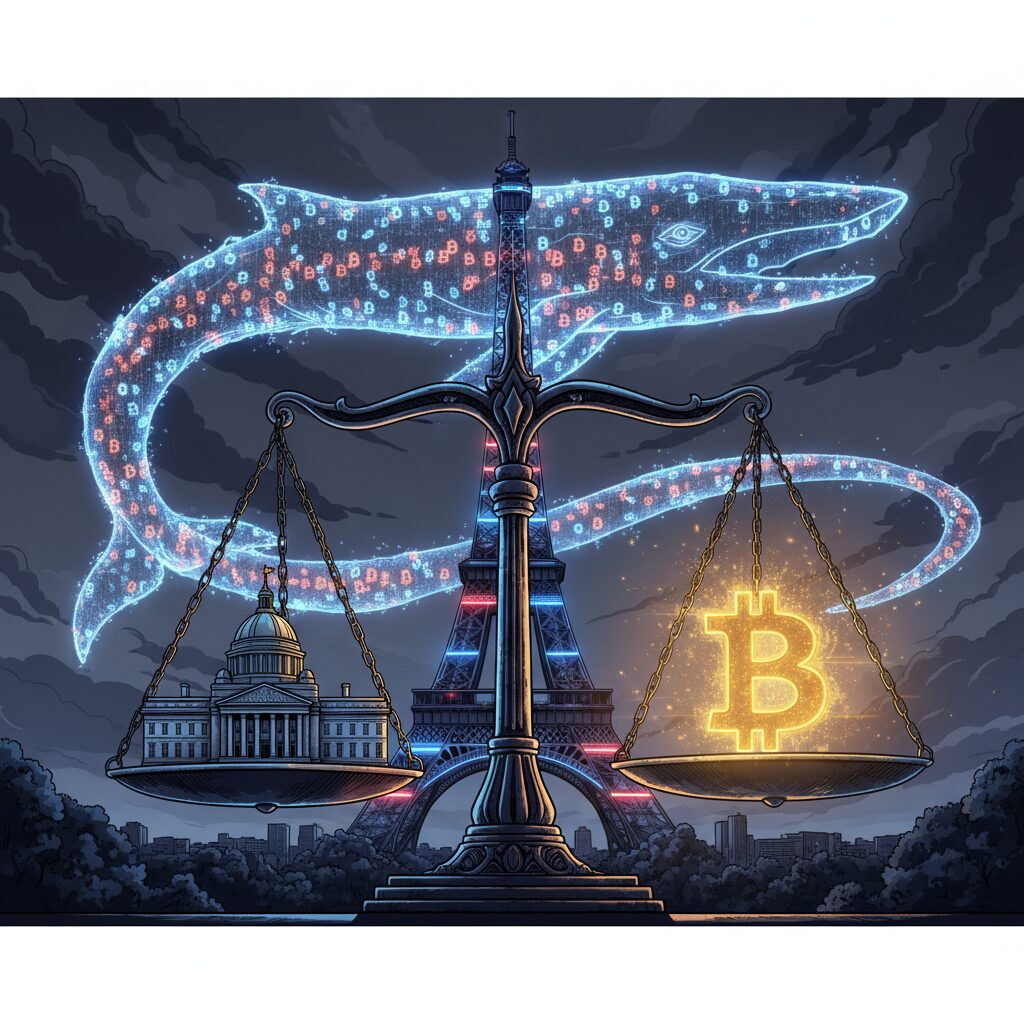

France Debates Landmark Crypto Bill to Establish National Bitcoin Reserve

The French Parliament is considering a new bill aimed at integrating Bitcoin and euro-based stablecoins into the nation’s financial system. Proposed by Éric Ciotti of the Union of the Democratic Right (UDR) party, the legislation seeks to protect France’s financial independence and position the country as a leader in Europe’s expanding blockchain landscape.

A National Bitcoin Reserve

A central component of the proposed bill is the creation of a public institution to manage a national reserve of Bitcoin (BTC). The plan calls for accumulating approximately 420,000 BTC, equivalent to 2% of the total supply, to establish a form of “national digital gold” intended to enhance France’s monetary resilience. The proposal also suggests using excess nuclear and hydroelectric energy to power public Bitcoin mining operations and adding BTC seized in legal cases to the national holdings.

To fund these acquisitions, the bill suggests allocating roughly $15 million daily from France’s popular Livret A and LDDS savings funds for direct Bitcoin purchases. Furthermore, it proposes allowing citizens to pay taxes using Bitcoin, though this measure would require constitutional approval to implement.

Promoting Stablecoins and Local Industry

The legislation also encourages the everyday use of euro-denominated stablecoins as a direct competitor to established payment networks like Visa and Mastercard. To spur adoption, it proposes a daily spending limit of $200 that would be exempt from taxes and social charges. The bill also includes a provision for these stablecoins to be used for tax payments. In a broader European context, Ciotti has urged the EU to relax its Markets in Crypto-Assets (MiCA) rules and to oppose the development of a centralized digital euro, or Central Bank Digital Currency (CBDC).

On the industry side, the proposal aims to support local crypto businesses by adjusting electricity taxation for miners and integrating digital assets into traditional investment plans. Ciotti argues that high-performance computing and Bitcoin mining are valuable economic activities, not just technological novelties.

Political Hurdles and Future Prospects

While the bill outlines an ambitious vision for France, its path to becoming law faces significant challenges. The UDR party holds only 16 of the 577 seats in parliament, making the chances of the bill passing slim without broad cross-party support. However, its introduction marks the first comprehensive attempt at crypto legislation in France.

If successful, the bill would represent a major step for the country in leading the blockchain revolution in Europe and strengthening its national financial standing. Even if it doesn’t pass, the initiative signals France’s growing commitment to adapting to a new monetary order driven by digital technology and could set a precedent for future policy discussions.