Ethereum to Power $2 Trillion Tokenized Asset Market by 2028, Says Standard Chartered

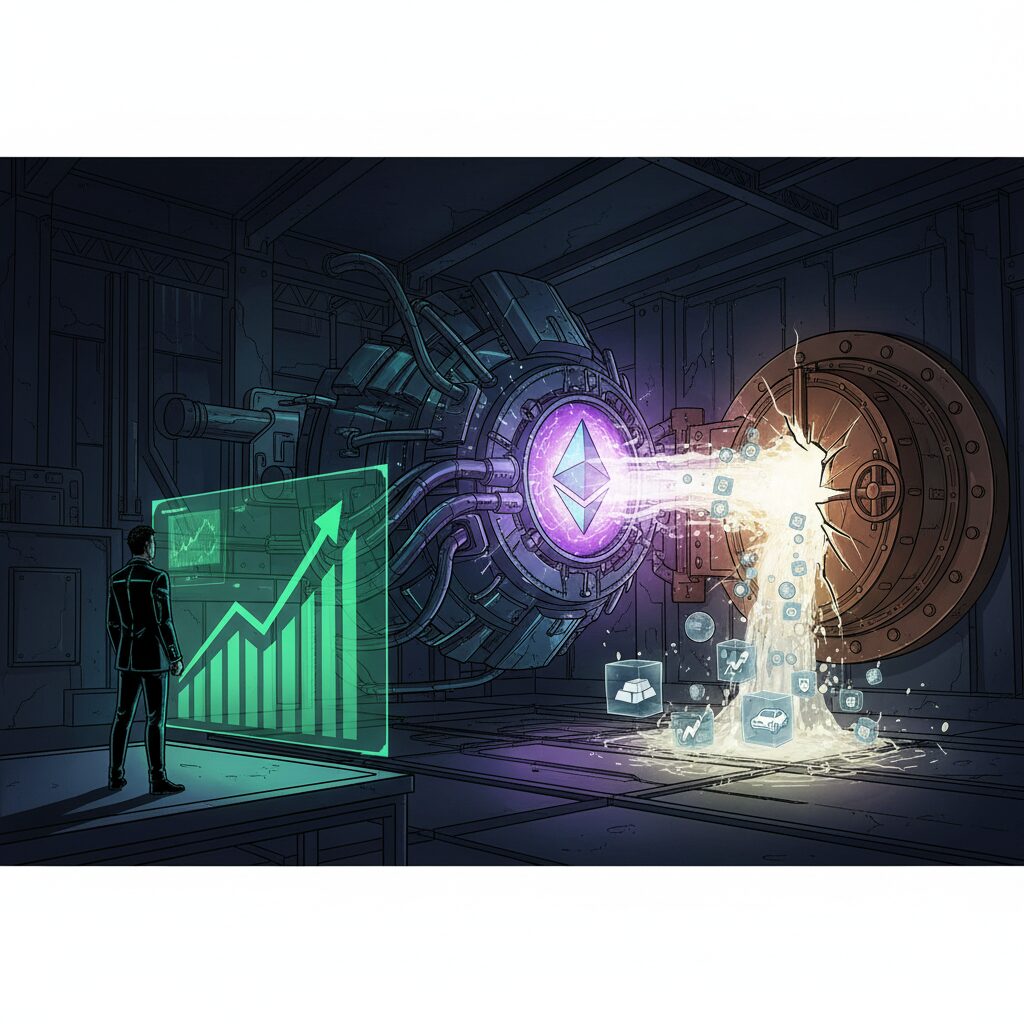

The market for tokenized real-world assets is projected to surge to $2 trillion by 2028, with Ethereum’s robust ecosystem positioned to capture the majority of this growth, according to a new report from Standard Chartered. This forecast highlights a major shift in finance, where blockchain technology is set to bridge the gap between traditional assets and digital infrastructure.

While financial institutions have been gradually adopting digital assets, analysts believe 2025 could mark a significant tipping point. The tokenization of everything from government bonds to real estate is expanding rapidly, and Ethereum is emerging as the preferred network for creating these institutional-grade digital representations.

Why Ethereum Leads the Tokenization Charge

Standard Chartered’s analysis predicts Ethereum will dominate the tokenization market, outpacing networks like Bitcoin. Its leadership stems from a powerful combination of features, including its advanced smart contract capabilities, a mature Decentralized Finance (DeFi) ecosystem, and growing regulatory acceptance.

Leading financial firms are already leveraging Ethereum to issue tokenized bonds and funds, using its programmable architecture to boost efficiency and dramatically reduce settlement times. High-profile projects like JPMorgan’s Onyx platform and BlackRock’s tokenized fund initiatives underscore a clear trend: Ethereum is evolving from a retail-focused network into an institutional backbone.

The Transformative Power of Tokenized Assets

The appeal of tokenized real-world assets lies in their ability to seamlessly merge physical and digital value. By converting assets like gold, real estate, or corporate debt into digital tokens, investors unlock fractional ownership, transparent record-keeping, and near-instant transferability.

Standard Chartered suggests this trend won’t just reshape asset management but will also democratize access to markets that were once illiquid and exclusive. For instance, real estate investment, previously limited to large-scale investors, can now be divided into tokenized shares, making it accessible to a global audience. The market is quickly embracing the transparency and automation that tokenization offers.

Institutional Confidence and Regulatory Tailwinds

A key catalyst for this growth is the increasing institutional interest in blockchain-based finance, which has been bolstered by greater regulatory clarity in major economies. Central banks and government agencies are actively exploring blockchain for financial instruments, signaling potential for wider adoption.

Ethereum is particularly attractive to institutions because it supports both private and public blockchain integrations. This flexibility allows enterprises to build compliant systems that meet strict regulatory requirements while still benefiting from the efficiency of blockchain technology. This clear regulatory momentum is giving large investors the confidence to move tokenized assets toward the mainstream.

The Foundation for a New Financial System

Standard Chartered’s prediction reinforces Ethereum’s position as the foundational layer for the future of tokenization. With ongoing network upgrades, including rollups and other layer-2 scaling solutions, Ethereum is actively addressing the performance demands of large-scale financial systems.

The movement is expected to expand beyond traditional assets to include everything from personal identity and carbon credits to infrastructure financing. The projected $2 trillion market isn’t just a number; it represents a new phase of technological maturity and a fundamental financial shift with Ethereum at its core.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice, investment advice, or any other sort of advice. You should not treat any of the website’s content as such. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.