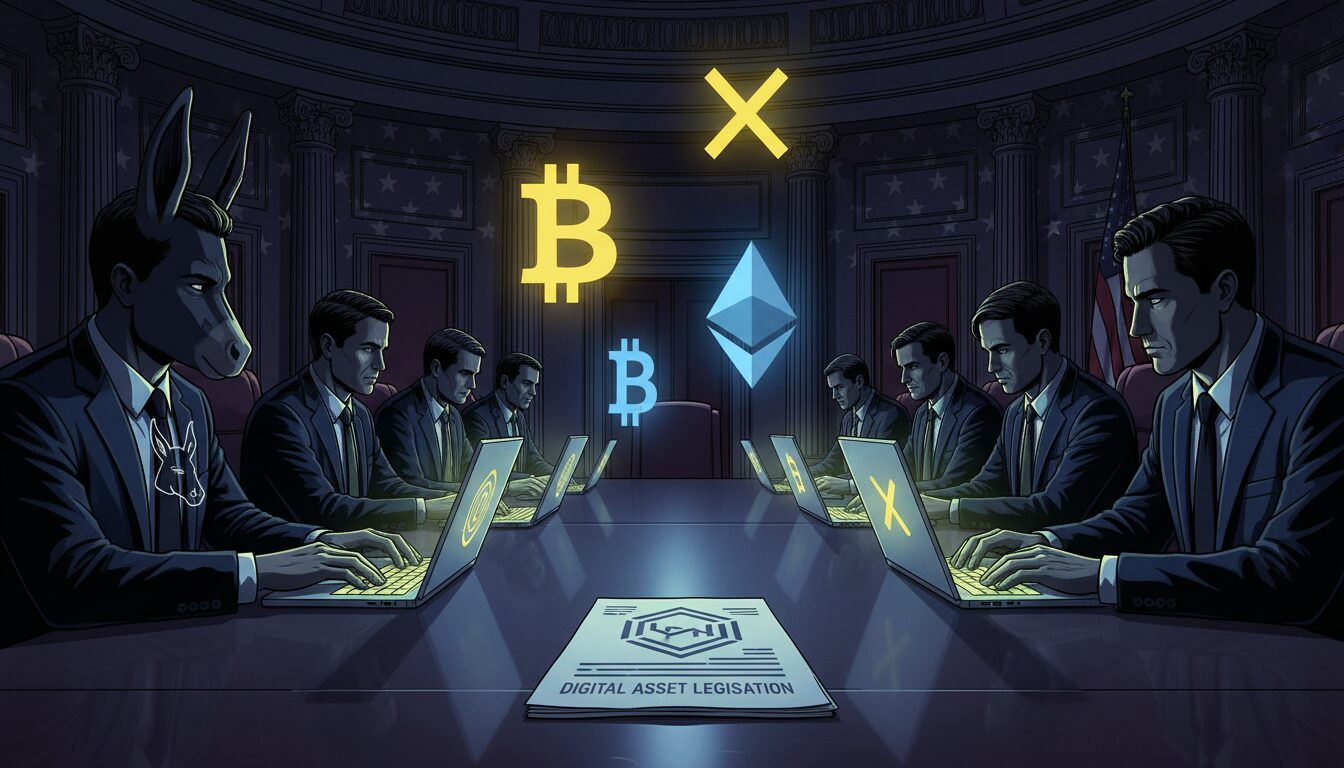

Democratic Lawmakers and Crypto Leaders Meet to Discuss Digital Asset Legislation

Top U.S. lawmakers and major figures from the cryptocurrency industry held a private roundtable on October 22 to address stalled digital asset legislation and the future of regulation. The high-stakes meeting aimed to find a path forward after a controversial proposal for decentralized finance drew sharp criticism from the sector.

The discussion, led by Senator Kirsten Gillibrand, brought together executives from leading firms like Coinbase, Ripple, Chainlink, and Uniswap. The primary focus was on establishing a clear market structure for digital assets and navigating the complexities of Decentralized Finance (DeFi) oversight.

Renewed Push for Compromise After Industry Backlash

The meeting was organized to reset dialogue after bipartisan negotiations broke down earlier in October. The breakdown followed a backlash against a leaked Democratic DeFi proposal that industry leaders warned would stifle innovation. Coinbase CEO Brian Armstrong had labeled the draft a “nonstarter,” arguing it could push developers and capital out of the United States.

In response, a coalition of over 20 crypto firms, including Chainlink and Binance.US, sent a letter to lawmakers urging them to adopt clear definitions that protect emerging technology. The industry has consistently argued that the proposed framework would effectively ban DeFi and self-custody wallets in the country.

A High-Profile Gathering on Capitol Hill

The roundtable marked one of the most significant direct engagements between U.S. policymakers and crypto executives this year. The list of attendees highlighted the meeting’s importance, featuring Coinbase’s Brian Armstrong, Chainlink’s Sergey Nazarov, Galaxy’s Mike Novogratz, and representatives from Kraken, Uniswap, Ripple, and Circle.

On the legislative side, Senator Gillibrand, a co-sponsor of the bipartisan Responsible Financial Innovation Act, was joined by other crypto-friendly Democrats. Senators Cory Booker, Mark Warner, and John Hickenlooper also participated, all of whom have previously advocated for clearer regulatory guardrails and expanded oversight for the Commodity Futures Trading Commission (CFTC).

While no new legislative text emerged immediately from the talks, insiders described the event as an “inflection point.” The roundtable was seen as a crucial effort by Democrats to rebuild trust with the industry and determine if a comprehensive crypto market structure bill can advance in the current Congress.