CBDCs Explained: The Promise and Peril of Digital State Currencies

A major shift is underway in global finance as over 90 nations explore the creation of Central Bank Digital Currencies (CBDCs). This global push is a direct response to the rise of private cryptocurrencies and digital payment platforms, prompting governments to modernize their financial systems and maintain control over monetary policy in an increasingly digital world.

The Case for a Digital Dollar

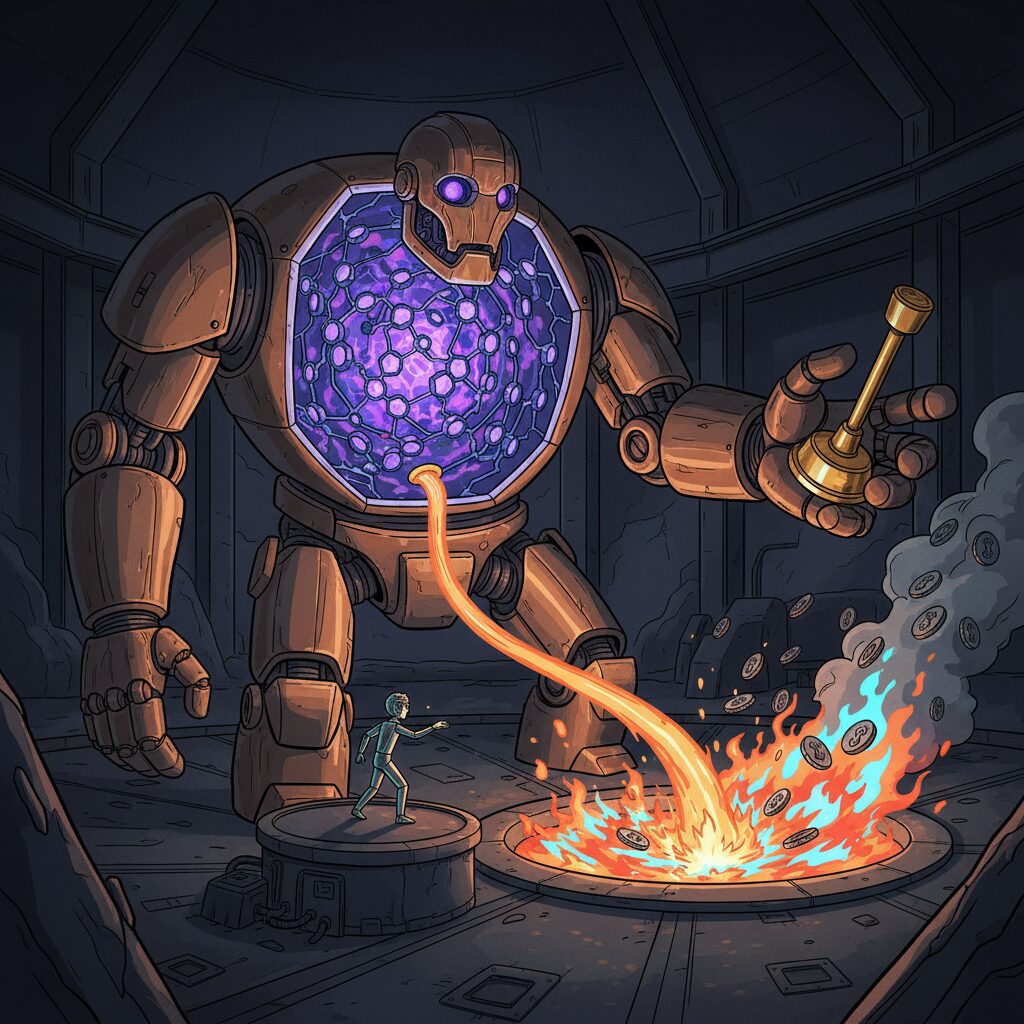

Proponents argue that CBDCs could revolutionize financial infrastructure. The technology promises to deliver instant, low-cost transactions that don’t require a traditional bank account, a development that could significantly expand financial inclusion for unbanked populations. Beyond simple payments, central banks are exploring the potential of “programmable money” to automate tax collection, streamline the distribution of government benefits, and provide real-time economic data for more effective policymaking. CBDCs could also simplify cross-border payments, reducing the current reliance on complex and slow correspondent banking networks.

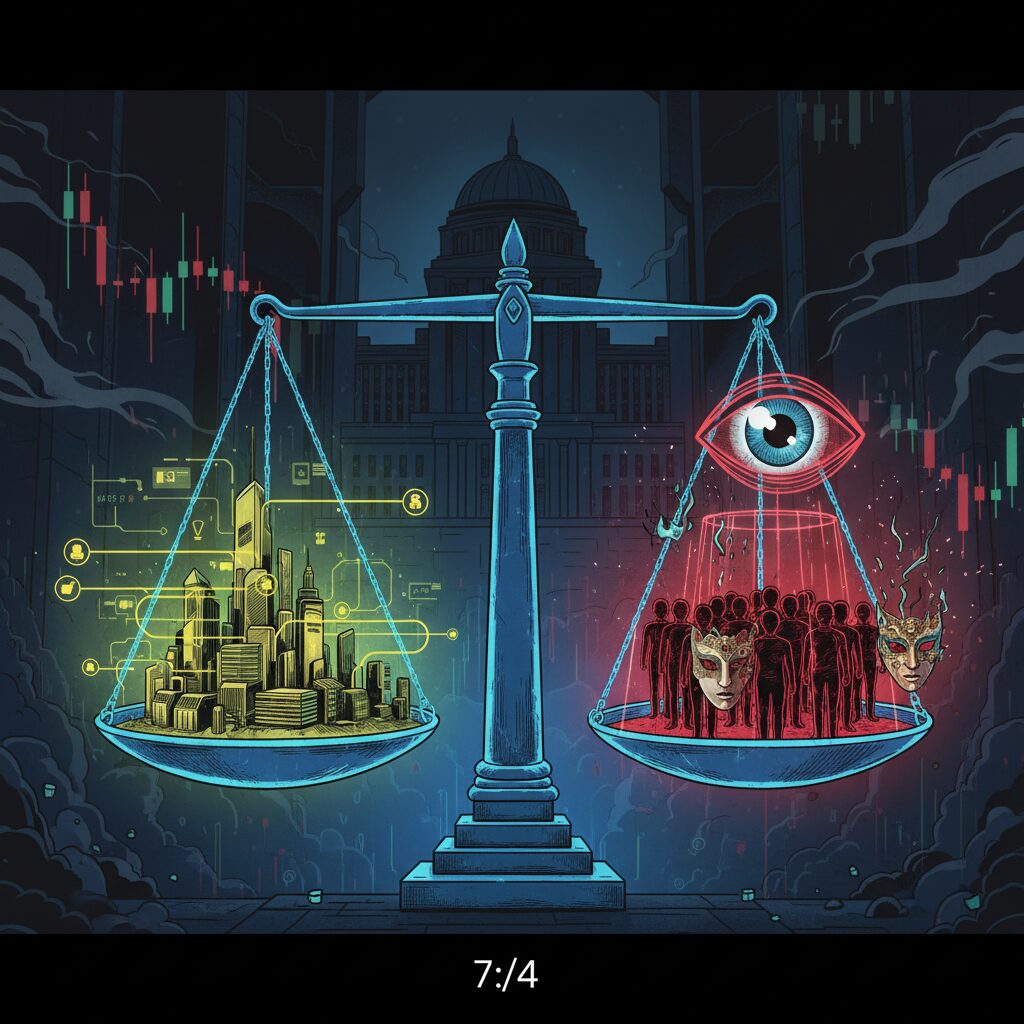

The Unavoidable Privacy Question

Despite the potential benefits, the move toward state-controlled digital currency raises significant privacy concerns. Unlike physical cash, which allows for anonymous transactions, a CBDC would create a permanent, traceable record of all spending. Critics warn this could grant governments unprecedented surveillance capabilities, allowing them to monitor individual financial activity. The core challenge for every nation developing a CBDC is finding a delicate balance: harnessing the efficiency of digital money without sacrificing citizen privacy or creating tools for authoritarian control.