Canadian Fintech Adopts Warren Buffett’s Playbook for Bitcoin Treasury

A Disciplined Pivot to Digital Assets

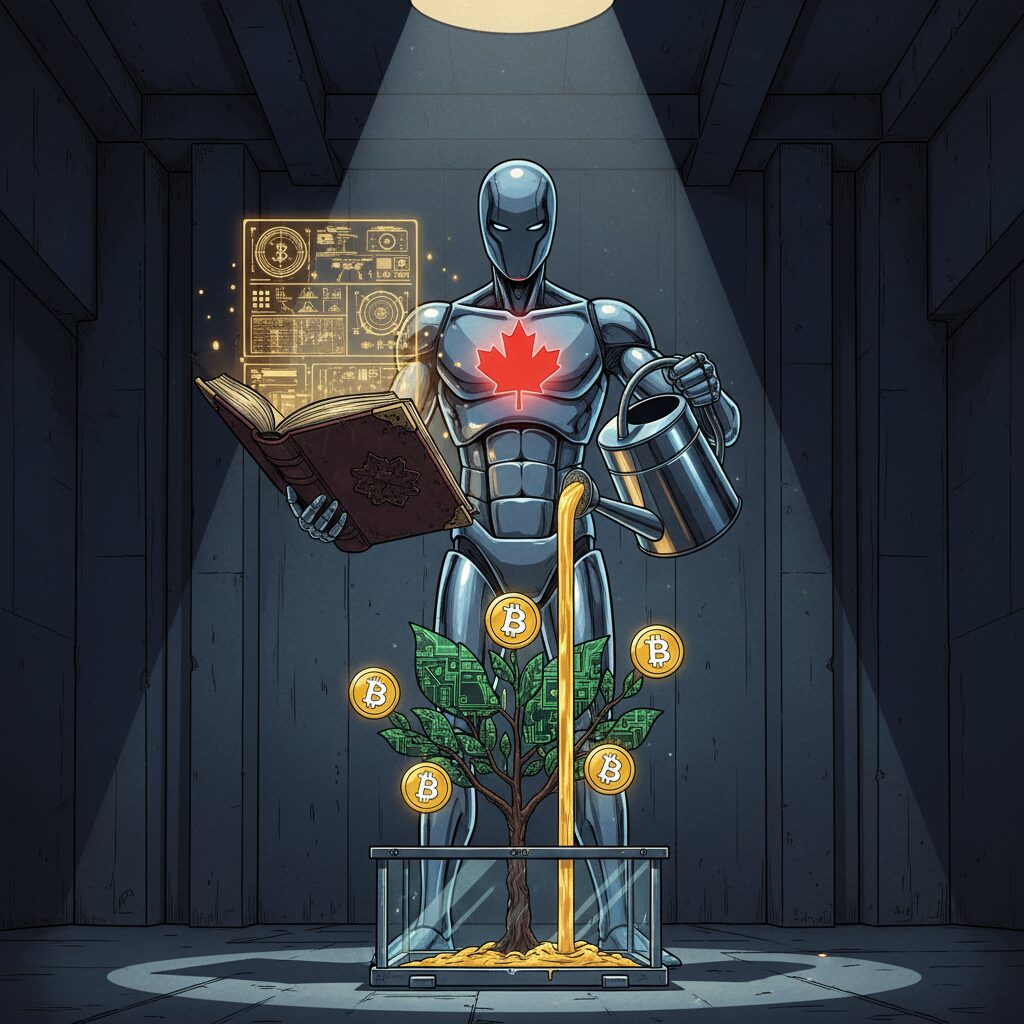

Canadian fintech company Mogo is applying the long-term, value-investing principles of Warren Buffett to its digital asset strategy. By designating Bitcoin as a primary reserve asset and prioritizing patience over speculation, Mogo is demonstrating a disciplined, Berkshire Hathaway-inspired approach that marks a structural shift for the firm.

The company officially adopted this new framework in May 2024, deliberately pivoting away from speculative trading to focus on the core tenets of Buffett’s philosophy: patience, temperament, and behavioral discipline. Eighteen months later, the strategy is yielding tangible results.

In its third-quarter 2025 report, Mogo announced it had increased its Bitcoin holdings by over 300% quarter-over-quarter, bringing its total to $4.7 million. Company President and co-founder Greg Feller confirmed that Mogo saw continued platform growth and record assets under management during the period.

Bitcoin as a Strategic Reserve Asset

This growth builds on a July 2025 board decision that authorized up to $50 million in Bitcoin allocations. The board formally designated Bitcoin as a long-term reserve asset and capital benchmark, signaling a structured, treasury-focused approach rather than short-term trading. These Q3 acquisitions were funded with excess cash and the monetization of other investments, all while maintaining operational liquidity.

The initiative is part of the broader evolution of Mogo’s Intelligent Investing platform, which integrates behavioral science to discourage impulsive trading and promote measured, long-term decisions. By pairing this disciplined framework with a growing crypto allocation, Mogo is bridging the gap between traditional value investing and modern digital assets.

This method stands in sharp contrast to the high-frequency trading and leveraged bets common in the retail crypto market. Feller stated that with the wind-down of its legacy trading business complete, the company is entering 2026 with a stronger foundation. By treating Bitcoin as a core part of its treasury, Mogo is creating a model for a more measured and thoughtful approach to participating in the digital asset economy.