Blockchain Conference Highlights Crypto’s Shift to Everyday Use

The recent Blockchain Futurist Conference, held on November 5 and 6, signaled a clear evolution in the digital asset space. The industry’s focus is pivoting from speculation and the concept of “digital gold” toward building practical, user-friendly applications designed for mainstream adoption. Conversations at the event consistently returned to a central theme: making blockchain technology invisible to the end-user.

A New Push for Financial Sovereignty

Eric Trump captured the sentiment of financial independence, telling attendees that his family is fully committed to cryptocurrency. He introduced American Bitcoin, a company he co-founded after he said his family was “debanked” by several institutions. Trump argued that blockchain technology can perform every function of big banks better, cheaper, and more transparently.

American Bitcoin employs a dual strategy to build its reserves. It purchases existing Bitcoin on the market while also generating new coins through its own mining operations. The company claims to mine BTC for roughly half its market price by setting up facilities in regions with extremely low electricity costs, such as West Texas. This cost-effective approach allows the company to add value to its treasury and increase the amount of Bitcoin represented by each share over time.

Trump described Bitcoin as a modern form of “digital gold” that offers financial freedom, particularly for those in countries with unstable currencies. He pointed out that its adoption curve is comparable to the internet’s in the early 1990s, suggesting monumental growth lies ahead.

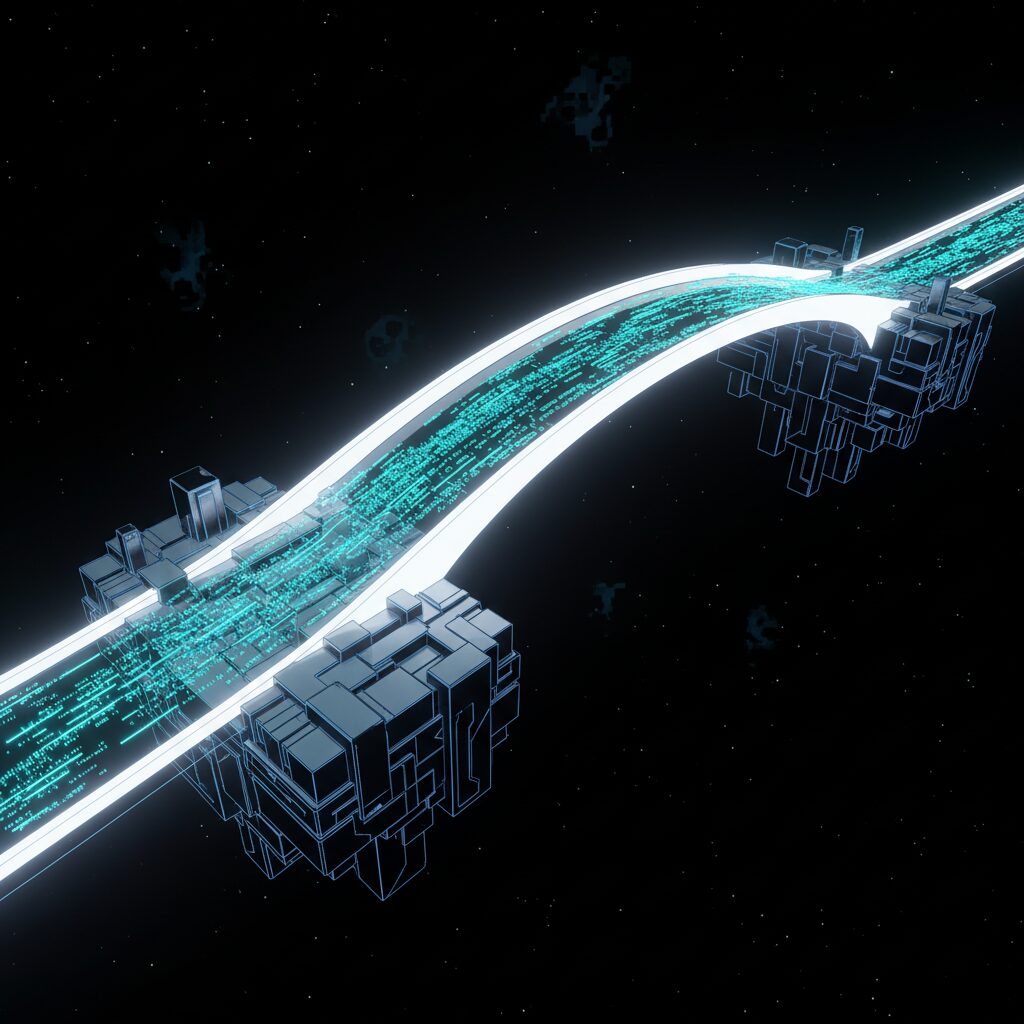

Simplifying the On-Chain Experience

Making crypto accessible was a key topic, with major players like Coinbase showcasing their efforts to hide the underlying complexity. For consumers, Coinbase provides a simple interface for interacting with Decentralized Finance (DeFi), allowing users to trade, lend, and borrow assets on-chain. For enterprise clients, it offers the infrastructure for banks and fintech companies to provide those same services to their own customers.

Echoing this mission, Jason Dominique, CEO of Onchain, explained his company was built to remove intermediaries from finance. He contrasted the “permissioned” nature of traditional finance—where users must ask for access to their own money—with the “permissionless” system his team is creating. Onchain’s Network Protocol (OPN) and consumer gateway enable anyone to buy smaller, niche assets using familiar payment options like Apple Pay, complete with smart guardrails to ensure a safe entry into DeFi.

Gamifying Fan Engagement with Web3

The push for usability extends beyond finance and into culture. NBA champion Tristan Thompson discussed his role as co-founder of Basketball.fun, a sports prediction platform built on the Somnia blockchain. The application aims to deepen fan engagement by allowing users to make live game predictions, collect tokenized moments, and earn rewards instantly.

Unlike traditional fantasy sports where bets are locked in, Basketball.fun operates on live, tradable shares that fluctuate in value as a game unfolds. This dynamic model allows users to cash out based on changing odds, turning passive viewing into an interactive experience. The platform is designed to appeal to millennials and Gen Z by directly linking engagement to the on-court action.

The overarching message from the conference was that blockchain technology is maturing. The industry is moving beyond hype and focusing on creating tangible value and seamless experiences, paving the way for crypto to become an integrated part of daily life.