Grayscale Report: Chainlink Is Essential Infrastructure for Tokenization

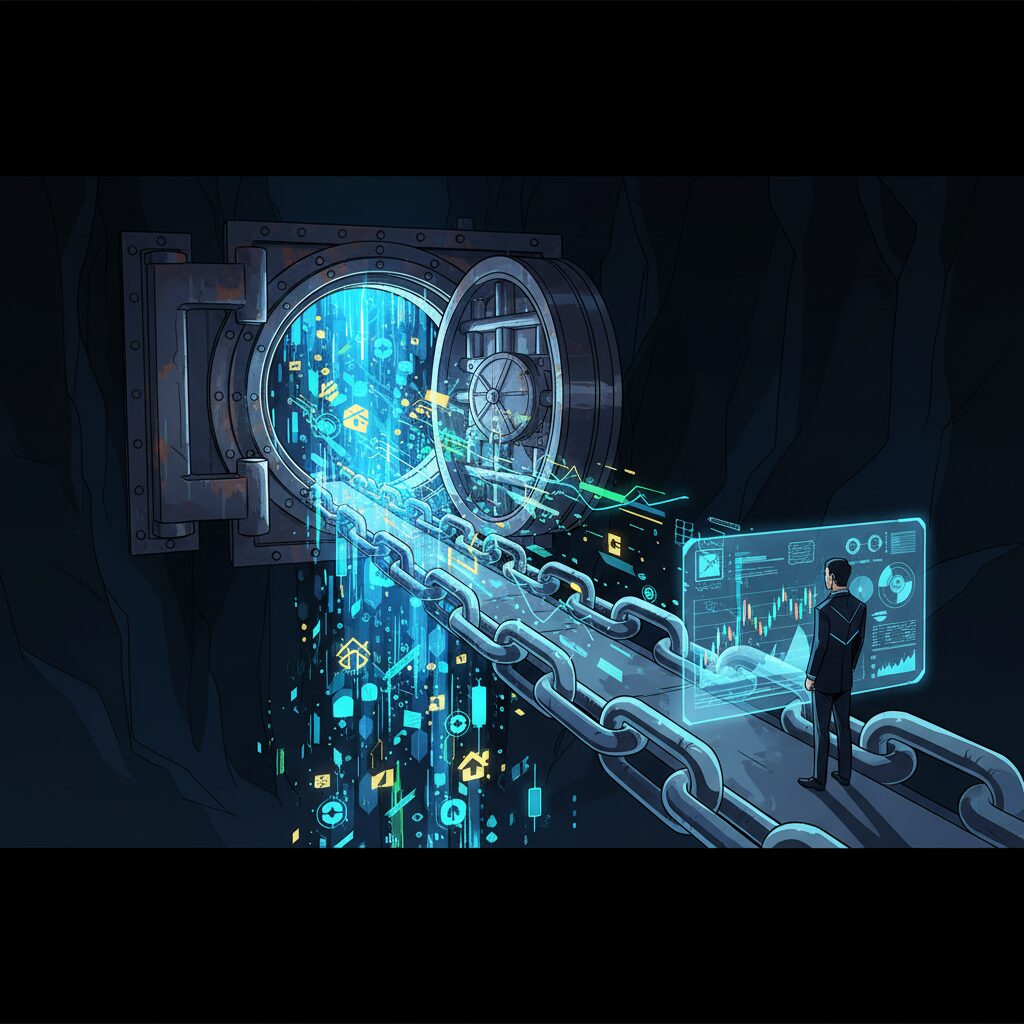

Asset manager Grayscale has identified Chainlink as a central component for the next major phase of blockchain adoption, describing the project as the “critical connective tissue” linking the crypto industry with traditional finance. In a recent research report, Grayscale argued that Chainlink’s expanding suite of tools is becoming indispensable for the tokenization of real-world assets and cross-chain settlement.

Evolving Beyond Oracles

According to Grayscale, Chainlink has grown beyond its initial function and is now better described as modular middleware. This technology enables on-chain applications to securely use off-chain data, communicate across different blockchains, and satisfy enterprise-level compliance requirements. The report highlights that this expanding role has helped establish LINK as the largest non-layer-1 crypto asset by market capitalization, excluding stablecoins, offering investors exposure to multiple blockchain ecosystems instead of just one.

Powering the Tokenization Market

Grayscale sees tokenization as the clearest path for Chainlink’s value proposition to shine. Currently, most financial assets like securities and real estate exist on off-chain ledgers. To benefit from the efficiency of blockchain technology, these assets must be tokenized and connected to external data sources for verification. The asset manager expects Chainlink to play a key role in orchestrating this process, citing strategic partnerships with financial data providers like S&P Global and FTSE/Russell. This sector is already experiencing rapid growth, with the tokenized asset market expanding from $5 billion to over $35.6 billion since the start of 2023.

A Successful Cross-Chain Pilot

In a practical demonstration of its capabilities, Chainlink, JPMorgan’s Kinexys network, and Ondo Finance completed a successful cross-chain delivery-versus-payment (DvP) settlement in June. The pilot connected JPMorgan’s permissioned payment network with Ondo Chain’s test network, which focuses on tokenized real-world assets. Using Chainlink’s Runtime Environment (CRE) as the coordination layer, the test involved exchanging Ondo’s tokenized U.S. Treasury fund for a fiat payment, with neither asset having to leave its native blockchain.