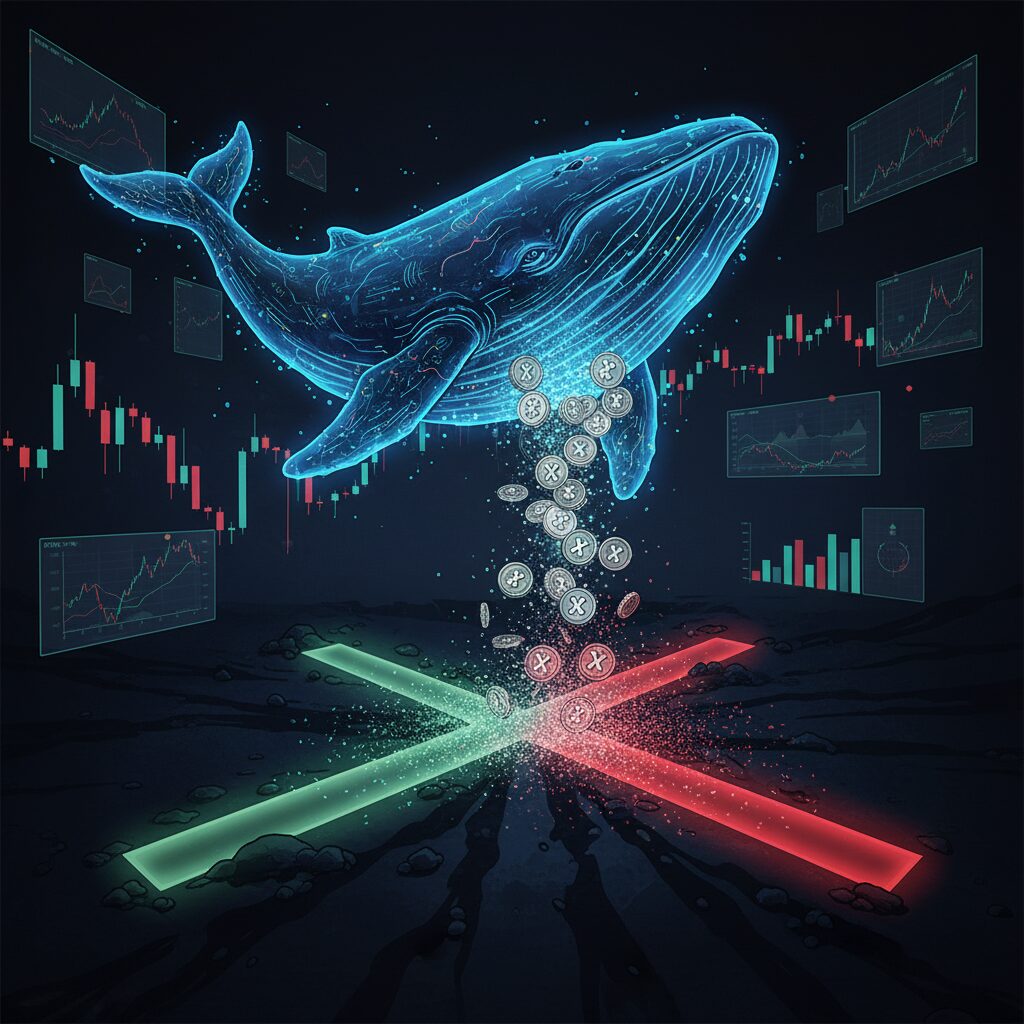

XRP Price at a Crossroads as Whales Unload 190 Million Tokens

XRP is facing a critical test after large-scale investors offloaded 190 million tokens over a 48-hour period, intensifying bearish sentiment. The sell-off has pushed the digital asset’s price toward a historically significant support zone between $1.81 and $1.90. With XRP currently trading around $2.02, the market is closely watching to see if this defensive wall can hold against the mounting pressure.

Whale Activity and a Weakening Market

The recent exit by major token holders, often called whales, typically reflects shifting expectations driven by macroeconomic conditions or internal market weakness. This instance coincides with a broader slowdown in liquidity across the altcoin market, compounding the negative sentiment for XRP. The token’s price chart continues to show a wide descending channel that has been in place since August, with each recovery attempt failing to break the trend.

Despite the persistent downtrend, recent price action hints at potential seller exhaustion. The chart has printed candles with long lower wicks and tighter trading ranges—a combination that often appears when sellers start losing control. This suggests that while the overarching structure remains bearish, the immediate downward impulse may be fading.

Signs of a Potential Reversal

Technical indicators are offering early signs of a possible stabilization. The Relative Strength Index (RSI), a key momentum indicator, is climbing from deeply oversold territory near 37. This is forming the early stages of a bullish divergence, a scenario where price makes a new low but the momentum indicator does not, suggesting the downtrend is losing strength. Historically, XRP has reacted strongly to similar technical setups, especially following high-volume sell-offs like the recent whale liquidation.

If the $1.81 support level holds, XRP could begin to form higher lows, the first step toward a trend reversal. Traders are eyeing the $2.15–$2.20 area as the initial upside target. However, the more significant barrier remains the descending trendline near $2.30. A daily close above that level would mark the first major structural improvement for XRP in months and could reopen a path toward $2.57 in the first quarter of the year.