Is Pi Network Forming a Price Bottom? A Look at the Adam and Eve Pattern

A Bullish Reversal Signal Emerges

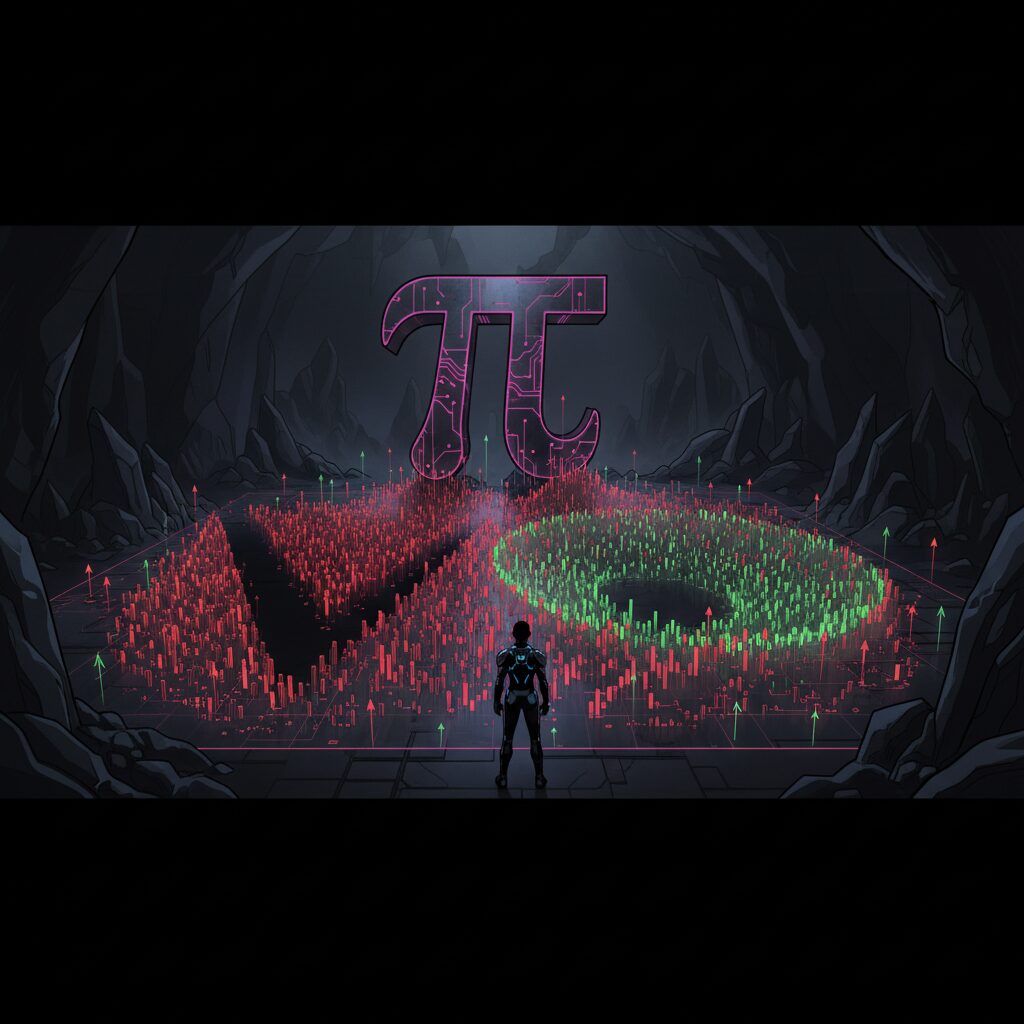

The price structure for Pi Network is showing early signs of a potential bottom, as a rare technical formation known as the Adam and Eve pattern takes shape. This classic bullish reversal signal, characterized by a sharp dip followed by a rounded recovery, suggests that selling pressure may be waning as buyer demand grows at a key support level.

This technical development comes as Pi Network gains attention for asserting its compliance with the European Union’s Markets in Crypto-Assets (MiCA) regulation in its push for listings on regulated exchanges.

Anatomy of the Adam and Eve Formation

The pattern emerging on the Pi Network chart consists of two distinct phases. The “Adam” component is the initial, sharp V-shaped sell-off and subsequent strong rebound. This aggressive dip is followed by the “Eve” phase—a more gradual, rounded bottom that indicates a steady return of buying interest and accumulation.

Adding credibility to this potential reversal is that the price is holding firm above the range’s point of control (POC). The POC represents the price level with the highest historical trading volume, acting as a strong indicator of market interest. When an asset trades above this level, it often signals that buyers are successfully absorbing supply, shifting market control in their favor.

Key Price Levels to Watch

For the Adam and Eve pattern to be confirmed, Pi Network’s price must break through the overhead resistance, or “neckline.” This critical zone currently sits between $0.21 and $0.28, an area where previous rallies have lost momentum. A decisive move above this neckline, particularly on increased trading volume, would validate the bullish reversal.

A successful breakout would open the door for a potential rally toward the next significant technical target around the $0.35 region. As Pi Network continues to grind higher and build its rounded base, the market appears to be transitioning from a distribution phase to one of accumulation, setting the stage for a potential upward expansion.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice, investment advice, or any other sort of advice. You should not treat any of the website’s content as such. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.