Corporate Crypto Buying Plummets as Market Cools

A Sharp Decline in Treasury Purchases

Corporate investment in cryptocurrency treasuries has seen a dramatic downturn, according to a recent Bloomberg report. Purchases of Bitcoin by publicly traded digital-asset treasuries fell from 64,000 BTC in July to just 12,600 in August. September figures showed a slight rebound to around 15,500 BTC, but this still represents a staggering 76% decrease from the peak activity seen in early summer.

This pullback coincides with broader market challenges, including a nearly 6% decline in Bitcoin’s price over the last week. The drop has been intensified by a wider market selloff marked by significant liquidations of leveraged positions.

Valuations and Regulatory Scrutiny

The companies at the center of this trend are facing severe consequences. Share prices for some treasury firms, particularly those that raised capital through Private Investment in Public Equity (PIPE) deals, have collapsed. Some are trading as much as 97% below their initial issuance prices.

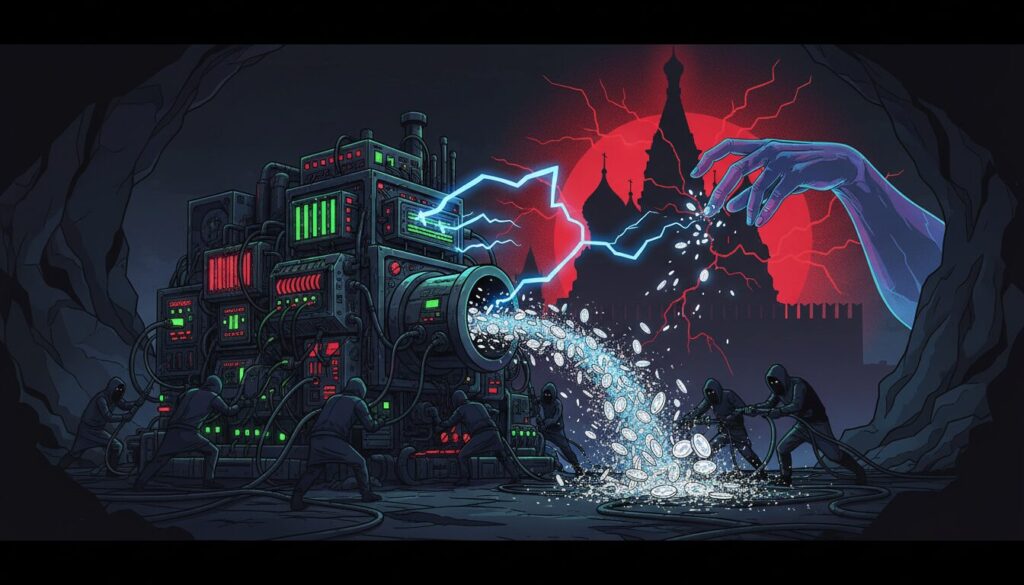

Adding to the pressure is growing regulatory scrutiny. Reports indicate that U.S. authorities have begun investigating “unusual trading activity” in the shares of these firms leading up to their crypto acquisitions. Markus Thielen, head of 10x Research, noted a general lack of transparency surrounding the acquisition prices and share counts, an issue complicated by warrants often included in PIPE deals that can dilute shareholder value.

As a result, the high premiums these firms once commanded have evaporated. The gap between their market capitalization and their net asset value (NAV)—the actual value of the Bitcoin they hold—is rapidly closing, signaling a sharp drop in investor confidence.

A Two-Speed Market Emerges

The retreat of corporate buyers is creating what Bloomberg describes as a “feedback loop” that undermines institutional support and creates a more fragile market. This has resulted in a “two-speed market” with conflicting signals. On one hand, derivative markets are showing significant stress. Demand for longer-dated futures has collapsed, and a recent 24-hour period saw $275 million in bullish Bitcoin positions liquidated.

On the other hand, investor appetite for certain crypto products remains strong. The iShares Bitcoin Trust, a spot exchange-traded fund (ETF), attracted $2.5 billion in inflows in September alone, a substantial increase from $707 million the month before.

Jeff Dorman, Chief Investment Officer at Arca, suggests the market weakness is a consequence, not a cause, of the corporate pullback. He contends that the absence of these major buyers has simply created a more cautious and uncertain trading environment.