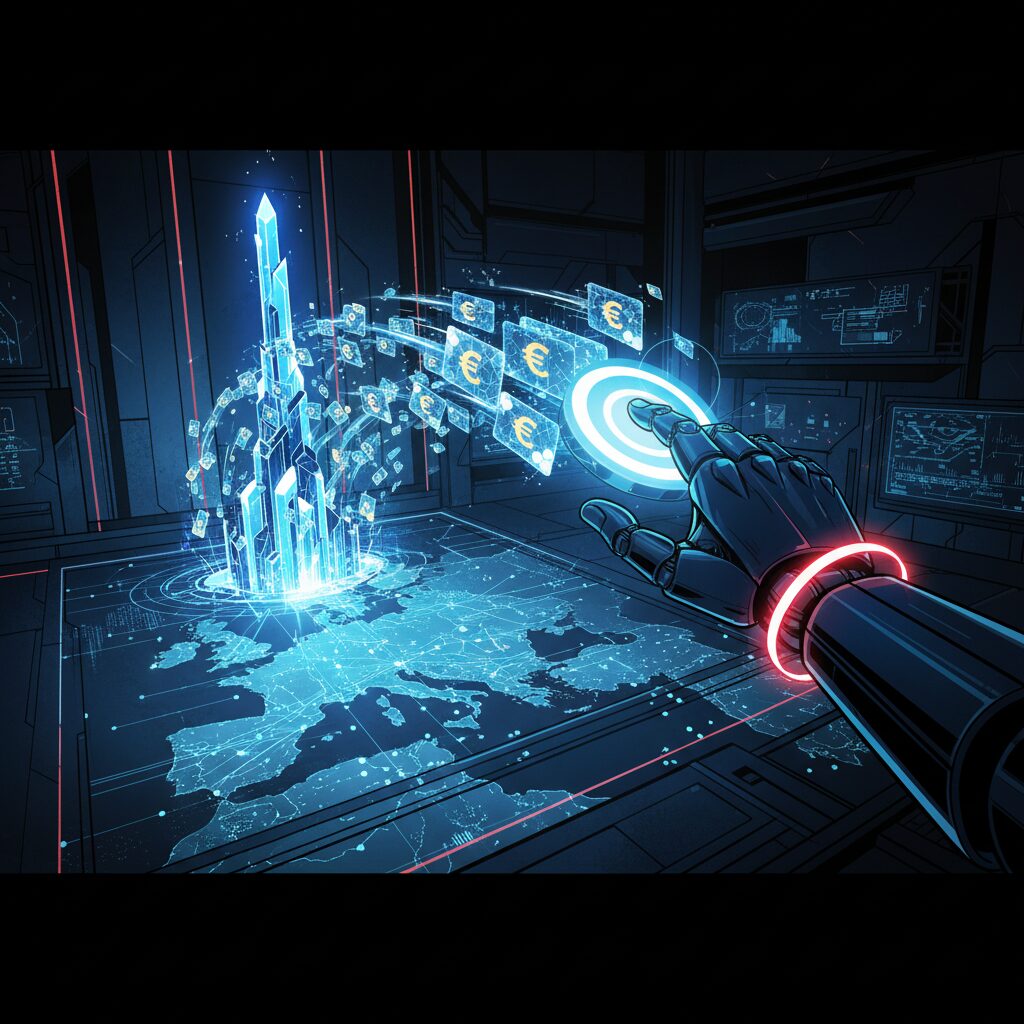

Citi Expands Blockchain Payments to Europe with Euro Support and Dublin Hub

Integrating Blockchain for 24/7 Liquidity

Citi has expanded its blockchain-based payment platform, Citi Token Services (CTS), to support Euro transactions through a new operational hub in Dublin. This development pushes the bank’s digital payments ecosystem beyond its existing presence in the United States, United Kingdom, Singapore, and Hong Kong, deepening its integration into Europe’s financial markets.

The addition of Euro transfers allows corporate and institutional clients to move funds around the clock, free from the constraints of time zones and traditional banking hours. At the core of the service is a private, permissioned blockchain that connects directly with Citi’s branches. This infrastructure enables continuous processing, a significant upgrade from conventional systems that rely on batch-based settlements. As a result, clients can achieve instant fund transfers and more effectively manage their liquidity across global operations.

A Strategic Step Toward a Multi-Currency Network

The expansion builds on the foundation laid in September, when Citi integrated its 24/7 USD Clearing platform with CTS. The Dublin hub now empowers clients to transfer both U.S. dollars and Euros to accounts at Citi branches worldwide, addressing long-standing challenges in managing liquidity during off-peak hours.

Launched in 2023, Citi Token Services for Cash has already processed billions of dollars in transactions. This latest move is part of the bank’s broader strategy to create a frictionless, multi-currency payment network that operates continuously. By merging tokenized deposits with its established cash management infrastructure, Citi aims to lead the evolution of institutional finance in an increasingly digital world.