Nextech3D.ai Merges AI and Blockchain to Reshape the Event Industry

A Unified Platform for Modern Events

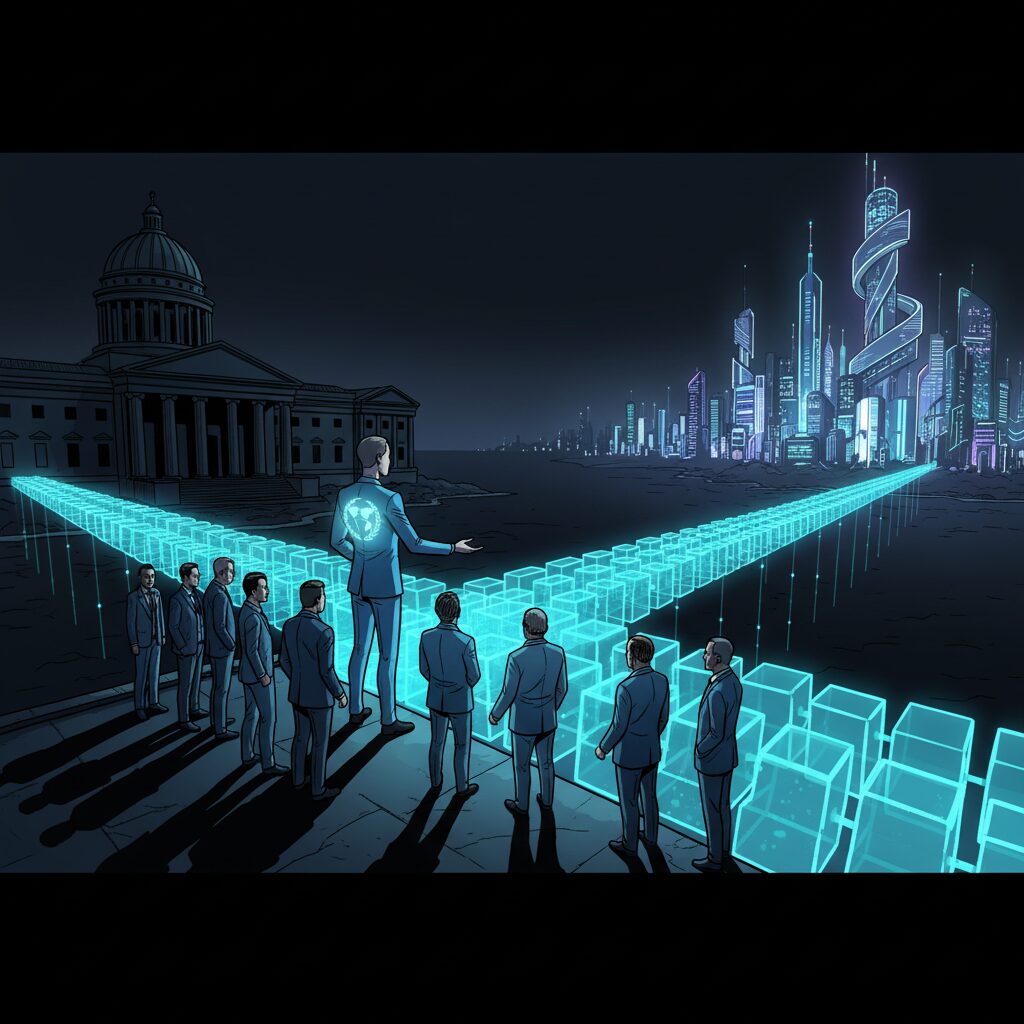

Nextech3D.ai is tackling the fragmented global events market with an integrated platform that leverages both artificial intelligence and blockchain technology. The company offers a comprehensive solution designed to manage every aspect of live, virtual, and hybrid events, from initial registration and ticketing to analytics and attendee engagement. This approach aims to replace the disjointed systems traditionally used in the industry, which often rely on multiple, non-communicating vendors.

Through strategic acquisitions of Eventdex and the Event Token ecosystem, Nextech3D.ai has consolidated key services into a single system. The platform now combines AI-powered matchmaking, mobile applications, and event logistics like badge printing with a secure, blockchain-based ticketing infrastructure. This creates a seamless experience for organizers and attendees in a market valued at over $85 billion.

The Power of Blockchain Ticketing

A core innovation of the Nextech3D.ai platform is its Ethereum-based blockchain ticketing system. This technology directly addresses long-standing industry problems like ticket fraud and scalpings. By creating a secure and transparent ledger, the system ensures the authenticity of every ticket. It also introduces new capabilities, such as programmable resale royalties for artists or organizers, sponsor airdrops directly to attendees, and cross-event loyalty rewards programs.

Strong Financials and Strategic Growth

The company operates on a software-as-a-service (SaaS) model built on recurring revenue, boasting impressive gross margins between 88 and 95 percent. With a base of over 500 recurring customers and a retention rate of 95 percent, Nextech3D.ai has established a stable financial foundation. This is highlighted by recent performance, as its Eventdex AI Matchmaking platform achieved $100,000 in year-to-date revenue in 2025.

The company’s direction is guided by CEO Evan Gappelberg, who is also its largest single shareholder with approximately 30 million shares. This significant insider alignment ensures that management’s interests are closely tied to those of long-term investors as the company pursues a path toward sustainable profitability.