Smart Money Signals Next Crypto Trend with AI Agent Token Accumulation

On-Chain Data Reveals Growing Investor Interest

A new investment narrative is taking shape in the cryptocurrency market, with analysts predicting that AI agent tokens could become a dominant theme in 2025. On-chain data shows that sophisticated investors and major token holders, often called “smart money,” are increasingly accumulating tokens associated with autonomous AI systems. These agents are designed to perform tasks like market analysis and trading without direct human intervention, signaling a potential shift toward assets with clear utility.

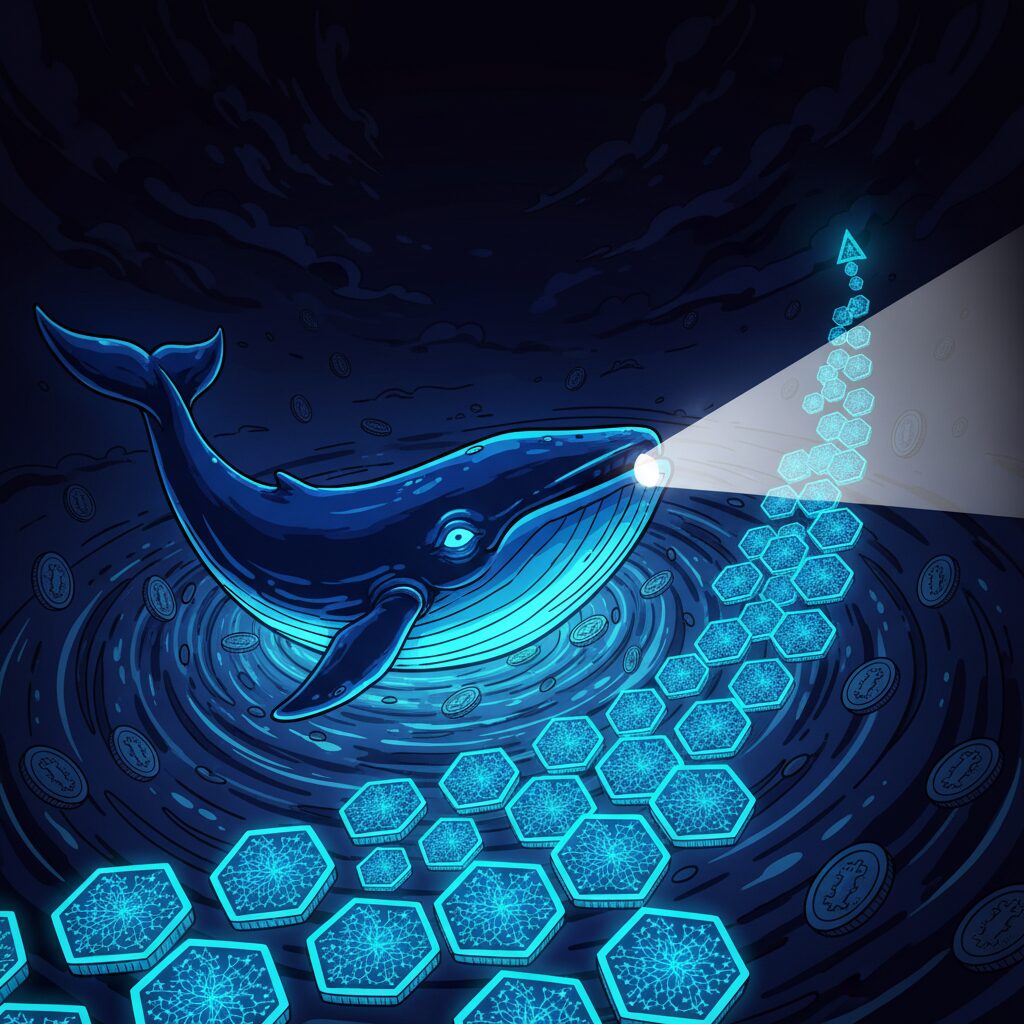

Patterns of Accumulation Emerge

Analysis of blockchain activity reveals clear patterns of accumulation among experienced investors. Whale wallets have shown significant interest in a diverse range of AI agent tokens, indicating that this isn’t a concentrated bet on a single project. Instead, investors appear to be building broad exposure to the growing ecosystem. For example, the AURA token has seen a notable 402% concentration among smart wallets, highlighting strong conviction from some of the market’s most successful participants. These investors often have a track record of identifying trends early and leveraging data to inform their decisions in areas like Decentralized Finance (DeFi) and yield farming.

Utility Separates Hype from High-Potential Projects

Unlike purely speculative assets, the leading AI agent projects are distinguished by their underlying utility. The VIRTUAL token from Virtuals Protocol, for instance, saw its price increase by 850% toward the end of 2024. Similarly, ai16z, a Solana-based decentralized autonomous organization (DAO) focused on AI investments, reached a valuation of over $2 billion in December 2024. These projects are developing AI agents that can scan and analyze vast amounts of on-chain and off-chain data in real-time, providing tangible value beyond simple token ownership.

However, the sector remains highly volatile. While the upside potential is significant, investors must recognize the risks. Tokens in this nascent category can experience sharp price swings, and decentralized networks can face challenges with speed and coordination compared to centralized alternatives.

The Future of a Decentralized AI Ecosystem

The convergence of AI and blockchain is expected to accelerate, with 2025 projected to be a year of significant scaling for AI agents. This growth will likely be driven by three key trends: the evolution of agent-to-agent and human-to-agent interactions, the increasing role of AI in directing on-chain financial activity, and the creation of new AI-driven ecosystems in sectors like gaming and entertainment. As the industry matures, the distinction between projects with genuine utility and those based on speculation will become much clearer. Smart money is already focusing on tokens with existing applications and diversifying across multiple protocols to manage risk while capturing potential growth.

Disclaimer: The information provided in this article is for informational purposes only and does not constitute financial advice, investment advice, or any other sort of advice. You should not treat any of the website’s content as such. Always conduct your own research and consult with a professional financial advisor before making any investment decisions.