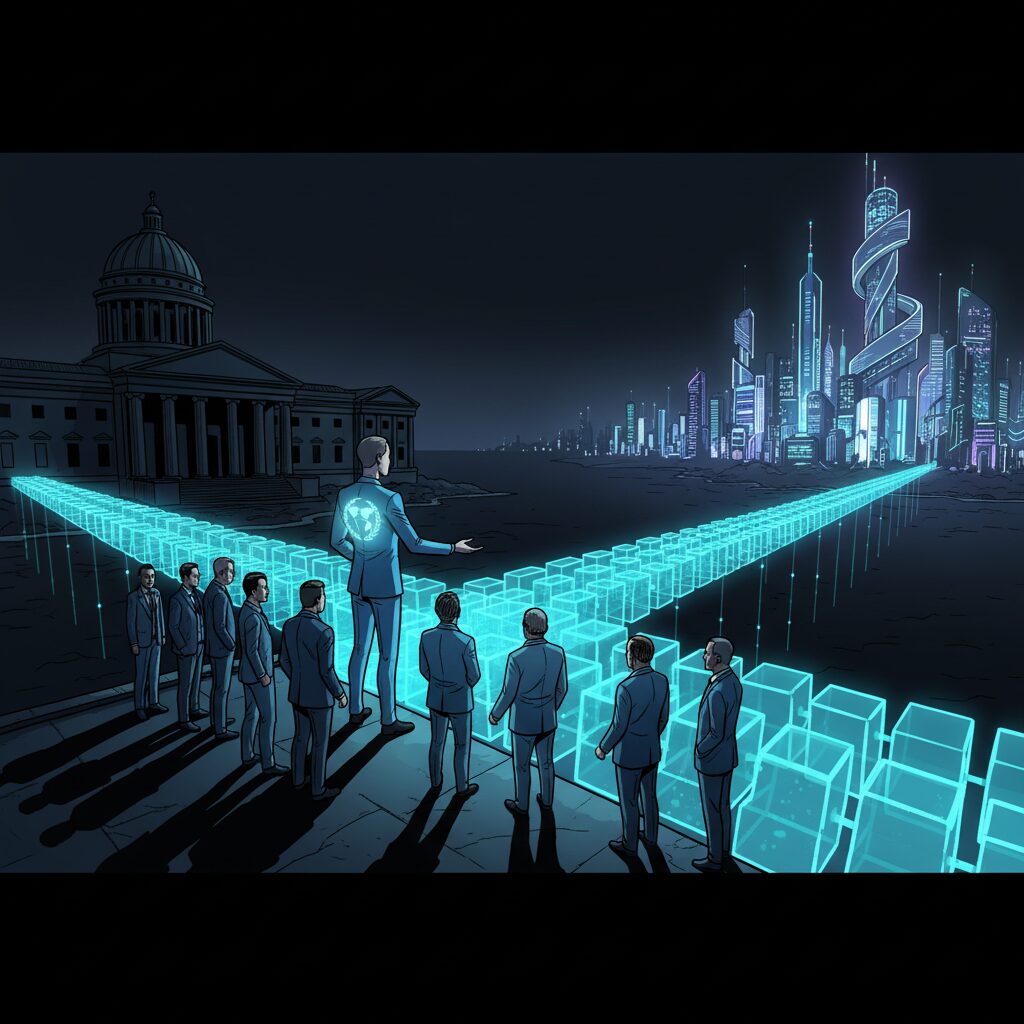

AllUnity Deploys Deutsche Bank

AllUnity, a joint venture between Deutsche Bank and asset management firm DWS, has launched its euro-denominated stablecoin, EURAU, utilizing Chainlink’s infrastructure to achieve broad multichain availability. The stablecoin is now active on Ethereum, Solana, Arbitrum, Base, Optimism, and Polygon, marking a significant step in creating an asset for institutional-grade digital payments and settlement.

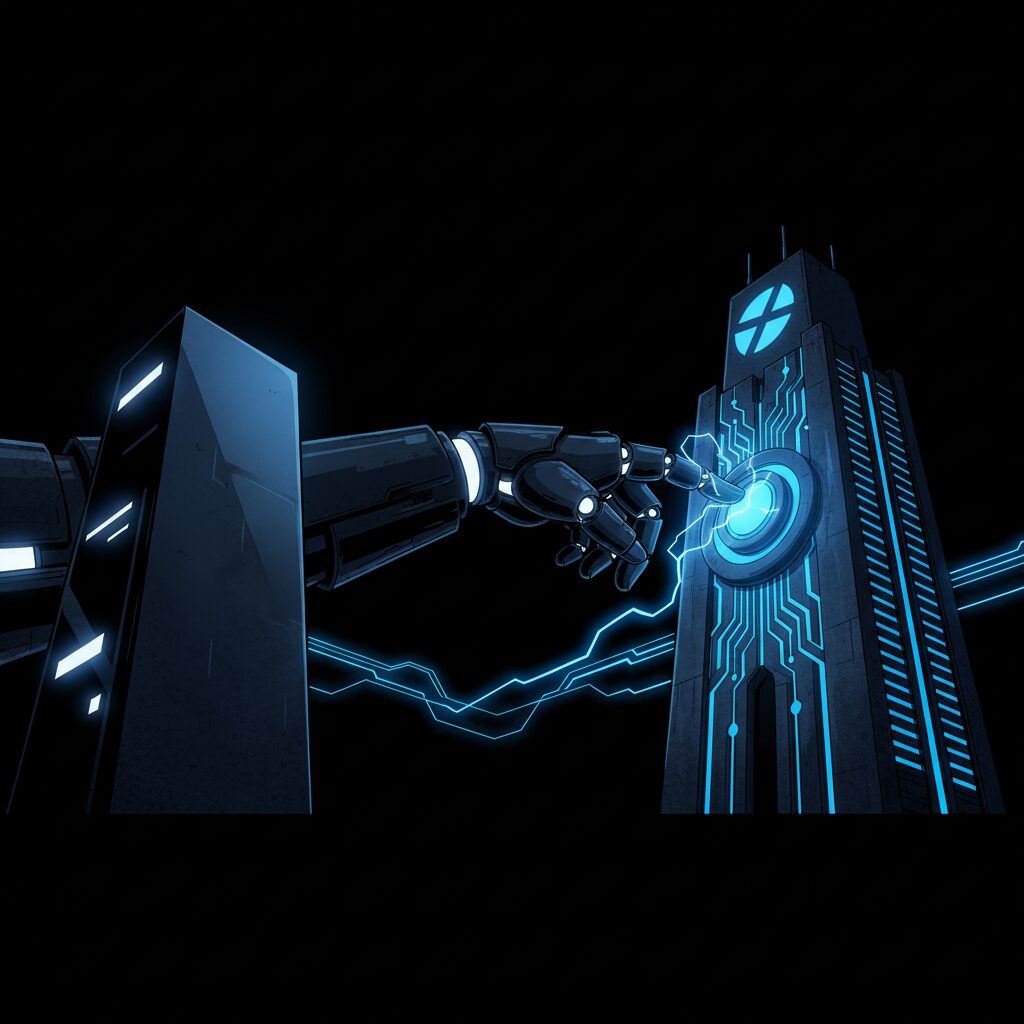

Chainlink Integration Powers Cross-Chain Functionality

The deployment relies on Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to ensure EURAU can move seamlessly between different blockchain environments. AllUnity’s leadership emphasized that this technology is central to its strategy, allowing the stablecoin to operate without friction and significantly expanding its accessibility. By using CCIP, EURAU can be transferred between networks without relying on centralized bridges, a key feature for institutional clients who prioritize security and transparency.

According to Chainlink Labs, this integration helps build a foundational layer for the future of tokenized finance in Europe. The protocol enables the secure transmission of tokens and data, allowing smart contracts to communicate beyond their native blockchains and supporting the growth of regulated digital assets.

A Stablecoin Built for Institutional Finance

EURAU is structured as a fully-backed stablecoin designed to comply with the European Union’s Markets in Crypto-Assets (MiCA) regulations. Its primary applications are business-focused, including corporate payments, on-chain treasury management, and cross-border financial operations. AllUnity also plans to introduce the token to the Canton Network, a blockchain platform tailored for high-compliance financial applications.

The project draws on the strengths of its parent companies. Deutsche Bank, with over $1.6 trillion in assets as of mid-2024, provides the core banking infrastructure and regulatory expertise. DWS, which manages more than one trillion euros in assets, contributes its investment and financial structuring capabilities to ensure the stablecoin meets institutional standards.

Regulatory Approval Signals Mainstream Adoption

In early July, Germany’s financial regulator granted AllUnity the license to issue the stablecoin, clearing the way for its launch later that month under MiCA-aligned rules. This regulatory approval is seen as a strong indicator of growing acceptance for blockchain-based payment systems, especially when backed by established financial institutions. Deutsche Bank’s active participation underscores a broader trend of traditional finance preparing for a future built on tokenized money systems, aiming to streamline settlement processes that are often limited by conventional banking hours.