Proposed Injective ETF Aims to Blend Staking Rewards with Regulated Investing

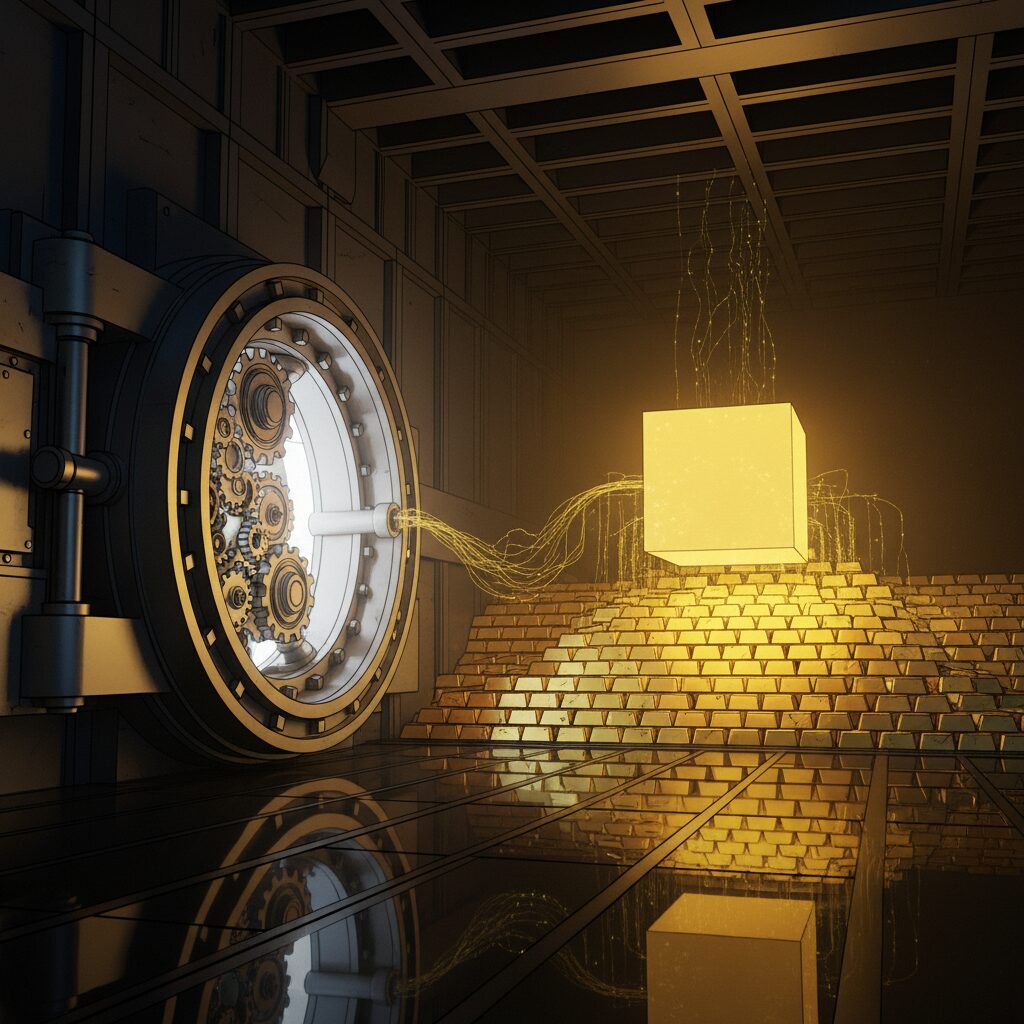

The cryptocurrency market may be on the verge of a new phase in institutional adoption with a proposed Injective (INJ) exchange-traded fund from 21Shares. The development marks a significant move toward bringing more complex altcoin products to mainstream investors, offering regulated exposure to Injective’s native INJ token while integrating a unique feature: staking rewards.

Injective is a high-performance Layer 1 blockchain designed specifically to power decentralized finance (DeFi) applications. As demand for crypto-based investment vehicles continues to grow, an ETF that provides both price exposure and passive income could significantly lower the barrier to entry for a wider range of investors.

A New Model for Crypto ETFs

The proposed Injective ETF is designed to offer a compliant and secure way for institutional and retail investors to gain exposure to the INJ token. Its most innovative feature is the integration of staking rewards directly into the fund’s structure. This allows investors to earn passive income from network participation without managing the technical complexities of staking, such as running nodes or delegating tokens through a crypto wallet.

This model simplifies the investment process and holds strong appeal for institutions seeking diversified crypto portfolios with yield-generating potential. The growing interest in this structure is clear, as Canary Capital has also filed for a staked INJ ETF. The success of similar Ethereum staking ETFs in Europe further suggests a strong market appetite for products that combine passive income with regulated asset exposure.

Under the Hood: Injective’s Blockchain Technology

Injective’s infrastructure is tailored for demanding financial applications, setting it apart from many other altcoins. The network is built for high throughput, reportedly processing over 25,000 transactions per second, and uses the Comet BFT consensus mechanism to ensure fast finality. This combination makes it suitable for use cases where speed and reliability are critical.

Built using CosmWasm, the blockchain also features cross-chain compatibility, allowing it to interact seamlessly with other networks to enhance liquidity and utility. The INJ token is central to the ecosystem, used for paying transaction fees, participating in governance, and securing the network through staking. With a capped supply of 100 million tokens, INJ has a market capitalization of approximately $1.4 billion.

The Regulatory Landscape and Institutional Backing

The approval of any crypto ETF hinges on the regulatory environment, primarily overseen by the U.S. Securities and Exchange Commission (SEC). Recent updates have streamlined the approval process, with the SEC reducing review periods from 270 days to around 75 days. However, staking-based products often face heightened scrutiny as regulators work to establish clear guidelines.

Injective’s credibility is bolstered by a series of high-profile institutional partnerships. Collaborations with major technology companies like Google Cloud, T-Mobile, and Deutsche Telekom strengthen its infrastructure and demonstrate its potential for real-world adoption, which can be a key factor in regulatory evaluations.

Broader Implications for the Crypto Market

A successful launch of the Injective ETF could have transformative effects on the broader cryptocurrency market. By making an altcoin with advanced features more accessible, it would lower the barrier to entry for a new class of investors. This could drive greater adoption and foster innovation across the DeFi space.

Furthermore, the approval of a staking-based ETF for an altcoin would set an important precedent, potentially paving the way for similar products and further diversifying the crypto investment landscape. As regulatory clarity improves and institutional interest continues to mount, such developments signal a maturing market for digital assets.

In the rapidly evolving world of blockchain, privacy has become a critical concern for users seeking greater control over their data and transactions. While the transparency of public ledgers is a core feature, it also means that financial activity can be easily tracked, creating challenges for those who require confidentiality.

The Rise of Privacy-Enhancing Protocols

To address this gap, a new generation of privacy tools is emerging. Protocols inspired by platforms like Tornado Cash work to obscure the link between a sender and a receiver, making it difficult to trace the flow of funds on-chain. On the Solana network, projects such as Voidify are working to implement similar solutions, aiming to transform blockchain security and offer users a higher degree of control over their financial information.