Pendle Surpasses $70 Billion in Settled Yield, Bridging DeFi with the Traditional Fixed

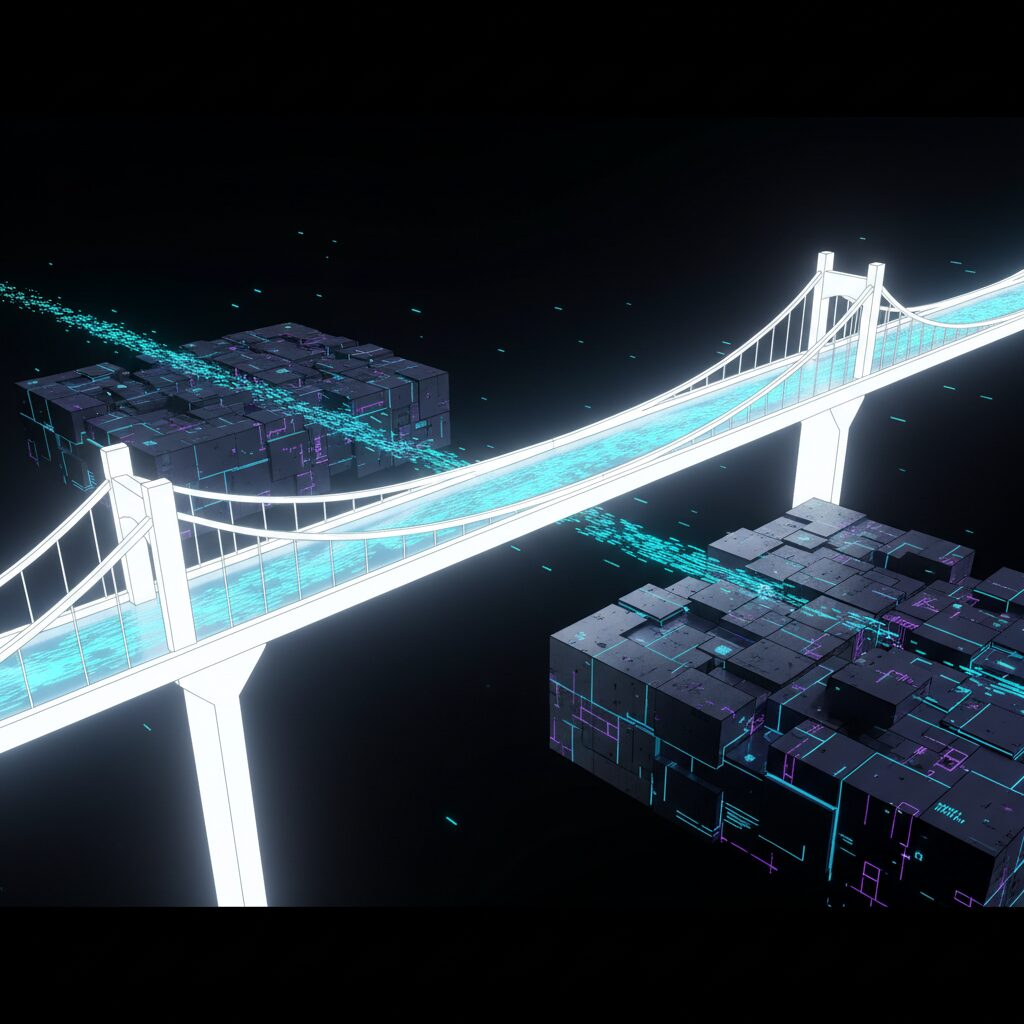

Pendle, a key player in the tokenization of yield within Decentralized Finance (DeFi), has reached a significant milestone, settling nearly $70 billion in fixed yield. The protocol, which has also attracted over $6 billion in Total Value Locked (TVL), is building a crucial link between the burgeoning crypto ecosystem and the massive traditional fixed-income market, which is valued at over $140 trillion.

This achievement highlights the growing influence of real-world asset (RWA) applications in DeFi. In a recent move to expand its offerings, Pendle integrated USDe yield markets through a collaboration with Ethena. This allows users to access tokenized fixed yields in a transparent, crypto-native environment, furthering the project’s ambition to create a programmable and permissionless world for fixed income.

Tapping a Trillion-Dollar Opportunity

The global fixed-income market, valued at $145.26 trillion in 2024, is one of the largest sectors in finance and is projected to approach $200 trillion by 2030. Dominated by giants like JPMorgan Chase, BlackRock, and The Vanguard Group, this market has long faced challenges with transparency, accessibility for smaller investors, and a reliance on intermediaries. Pendle aims to address these inefficiencies by introducing a more open model through decentralized financial instruments.

By building a fixed-rate layer for RWAs, Pendle is positioning itself to provide institutions with a scalable on-ramp to DeFi-native fixed-income products, potentially disrupting a market that has been slow to innovate.

A Distinct Approach to Yield

Pendle’s core innovation is its ability to split yield-bearing assets into two distinct components: Principal Tokens (PT) and Yield Tokens (YT). This separation allows fixed yield to be programmed and traded on-chain, mirroring a fundamental mechanism of traditional finance. By integrating with various DeFi protocols, Pendle has successfully developed fixed-rate markets for stablecoins and other real-world assets.

The platform’s growth, marked by its $69.8 billion in settled fixed yield and over $6 billion in TVL across Ethereum and other networks, demonstrates the stability and appeal of its decentralized fixed-income solutions for both individual and institutional participants.

The New Frontier of Tokenized Finance

Tokenizing fixed-income assets introduces a new level of efficiency and accessibility to a traditionally rigid market. This model offers continuous liquidity and trading, global access without intermediaries, and the ability for fractional ownership, which significantly lowers the barrier to entry. Furthermore, these tokenized assets are interoperable within the broader DeFi ecosystem, unlocking new financial strategies.

As institutional interest in digital assets grows, platforms like Pendle are creating the essential infrastructure that connects traditional finance with DeFi. The predictability and risk management capabilities offered by fixed-rate instruments are critical for attracting these larger market players. Currently, stablecoin-based fixed yields on Pendle can reach approximately 20%, offering a compelling alternative to the roughly 12% yields seen in high-risk CCC-rated corporate bonds.

Looking Ahead

Pendle’s work represents more than just a DeFi protocol; it provides a framework for broadening access to capital across both traditional and decentralized markets. As the financial system continues to digitize, the fusion of crypto infrastructure with fixed-income markets could redefine how value is managed and grown. With recent innovations like Boros, a product for trading exchange funding rates, Pendle continues to push the boundaries of what’s possible in DeFi.