The Forgotten Fortune: Over $4 Billion in Bitcoin Remains Locked in Physical Coins

A Relic from Bitcoin’s Early Days

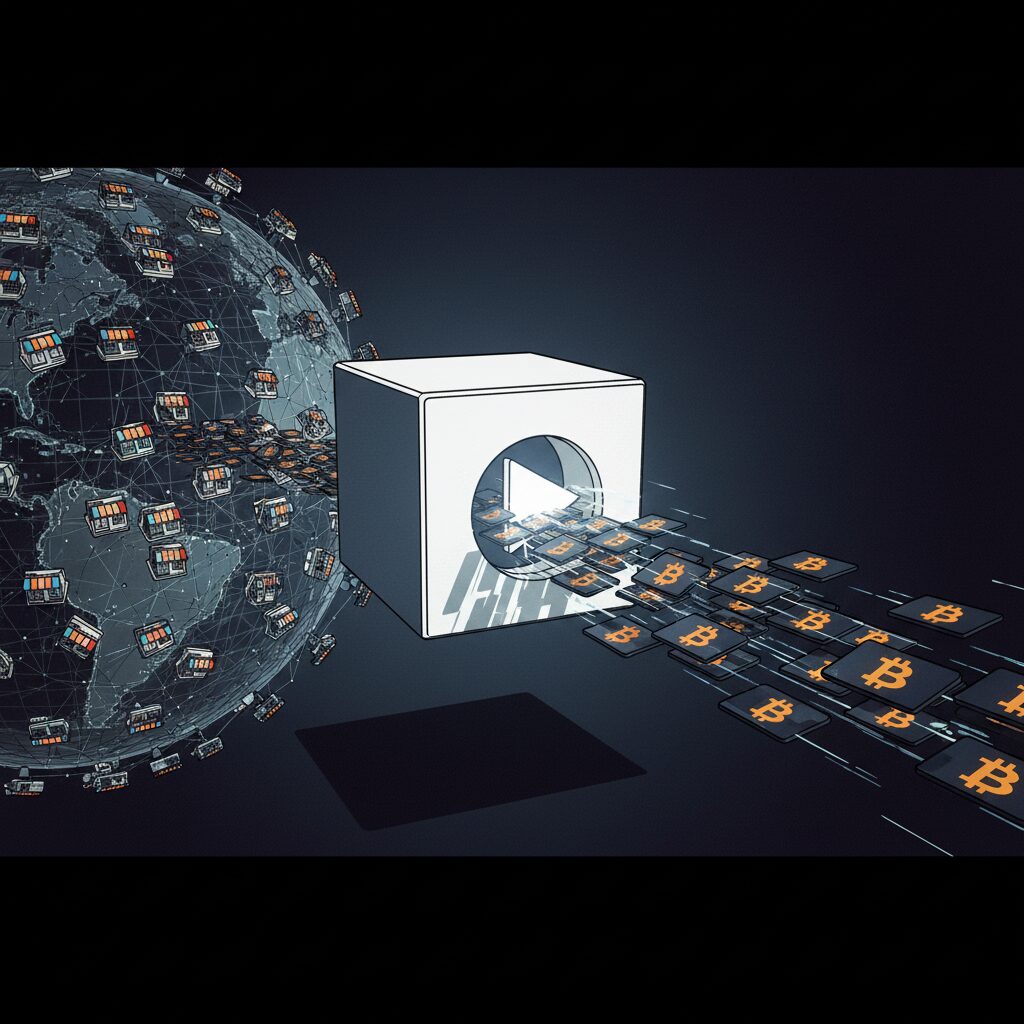

More than a decade after their creation, a unique collection of physical bitcoins known as Casascius coins still holds a vast, untouched fortune. As of 2025, over 38,000 bitcoins—worth more than $4 billion at current prices—remain secured within these historical artifacts. While some owners have recently redeemed their holdings, with over 1,100 BTC valued at $119 million unlocked this year alone, the vast majority of this early wealth lies dormant.

Created by Mike Caldwell between 2011 and 2013, Casascius coins represent a pivotal chapter in cryptocurrency history. Each coin contains a private key hidden beneath a tamper-evident hologram, allowing its owner to access the digital bitcoin it represents. They were one of the first successful attempts to give the world’s leading digital currency a tangible form.

The Unclaimed Treasure

The fact that so many of these coins remain unpeeled raises intriguing questions about their owners. Some may be holding them as a long-term investment, confident in Bitcoin’s future growth. Others, however, may have simply lost them, forgotten their existence, or passed away, leaving the wealth locked away forever. Each unopened coin is a small mystery, a testament to the foresight—or misfortune—of an early crypto adopter.

These coins were purchased when Bitcoin was a fringe asset, far from the global financial instrument it is today. The immense value now sealed inside them highlights the conviction and risk tolerance required of the market’s first pioneers. For them, a Casascius coin wasn’t just a novelty; it was a bet on a completely new kind of money.

From Utility to Collectible

Over time, Casascius coins have transformed from a simple storage method into highly sought-after collectibles. Their value is no longer tied just to the bitcoin they contain but also to their historical significance and rarity. This has created a niche market for collectors who appreciate the intersection of technology, finance, and art, with demand often rising alongside Bitcoin’s market performance.

The allure is clear: these physical items offer a sense of ownership that purely digital assets can’t replicate. They serve as a tangible link to the humble beginnings of a technology that has since reshaped financial markets, appealing to both crypto enthusiasts and numismatists alike.

The Enduring Risks of Physical Crypto

Despite their appeal, holding wealth in this form isn’t without risk. While they solve some digital security problems, they introduce physical ones. The coins are vulnerable to loss, theft, and damage, and their increasing value makes them a prime target. There are also long-term concerns about the physical degradation of the coin or the hologram protecting the private key.

The story of Casascius coins mirrors the broader narrative of Bitcoin itself—a journey from a niche experiment to a mainstream asset. As the digital currency landscape continues to advance, these physical artifacts stand as a powerful reminder of the innovation and risk that fueled Bitcoin’s rise.